Better conditions for M&A ahead?

Better conditions for M&A ahead?

As we move into the second half of 2025, we consider how merger and acquisition (M&A) activity has evolved in the first six months of the year and the outlook for the remainder of the year and beyond. 2025 began with a sense of market optimism. The rationale being a more buoyant final quarter of 2024 aided by reductions in central bank interest rates. The Bank of England and the US Federal Reserve cut rates in August and September 2024 respectively and this was seen as a signal to the market that rates had passed their peak and the cost of finance should be lower going forward. Furthermore, the election of President Trump in November 2024 was expected to provide a tailwind from financial deregulation. All helpful for M&A activity.

Down but not out

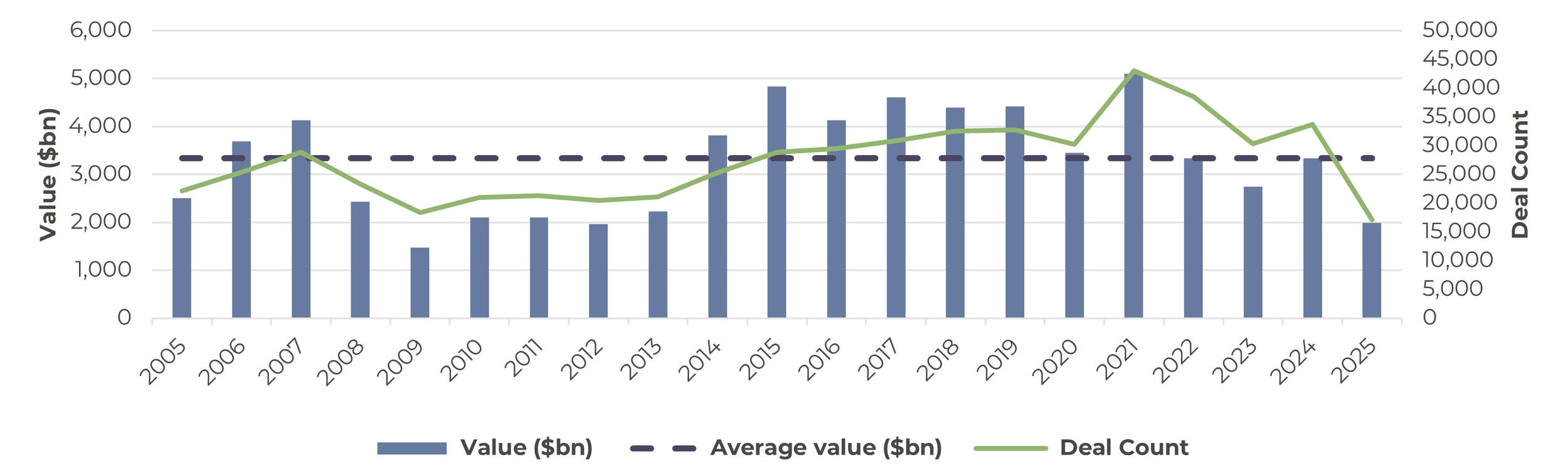

M&A global deal count and the total value of deals peaked in 2021 and have been at lower levels since. The key reason for this is adjustment to the rise in central bank interest rates, enacted to combat inflation. In the US for example, the Federal Reserve raised rates aggressively from 0% to 5.5% between early 2022 and mid-2023 and the picture in the UK and Europe was not materially different.

Global M&A

Source: Artorius, Bloomberg

Higher interest rates not only increase the cost of borrowing (which affects financing of deals) but subsequently, impact investors’ views on risk and valuation. For context 10-year US government bonds which are often seen as proxy for a ‘risk-free’ rate saw their yield increase from approximately 1.5% in early 2022 to over 4% towards the end 2023. This increase then had a knock-on impact for the majority of other asset classes. The result, M&A activity slowed, but interestingly despite some quite pessimistic market views, the data suggests some degree of resilience despite the reduction. We highlight that in 2024, the value of deals globally according to Bloomberg was below the peak of $5.1tn but at $3.3tn was still in line with the 20-year historic average. In terms of deal count, 2024 had 33,659 deals which is actually above the 20-year average of 27,871.

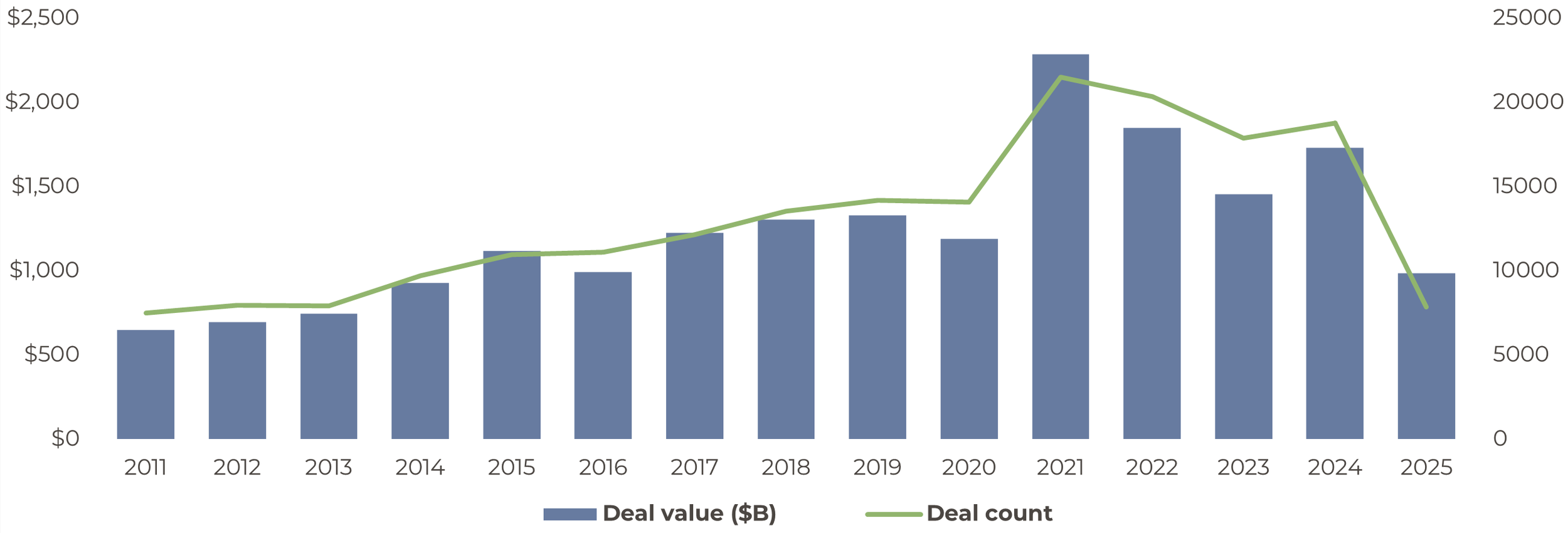

Private equity driving M&A

Private equity (‘PE’) is a key driver of M&A activity. This is highlighted in the chart below where notably the picture is very similar to that of the Global M&A data. The difference between the two is deal activity where no PE firm is involved in the transaction i.e. company to company transactions or acquisitions by other investor types such as sovereign funds, wealthy individuals and syndicates for example.

Global PE Deal Activity

Source: Pitchbook, Artorius

Adapting to uncertainty

Whilst there is a lot of discussion around how uncertain financial markets are at present, it has been a theme of recent years. The difference has been the drivers of uncertainty. Looking back, we had the COVID pandemic in 2020 and then Russia’s invasion of Ukraine in 2022. The latter adversely impacted energy supply chains in Europe. Sharp increases in inflation were the next issue both in the US and Europe with the latter exacerbated by higher energy costs. Central banks responded with interest rate increases throughout 2022 into 2023. Uncertainty is generally perceived as a negative factor for financial markets because it leads to a ‘wait and see’ approach.

2025: Not quite as expected

This leads us to 2025 which has not quite panned out as expected to date. On the 2nd April 2025, President Trump’s ‘Liberation Day’, tariffs were announced, mainly on those countries that had a trade surplus with the US and some that don’t including the UK. This has had a material impact on sentiment in financial markets and it has still not been resolved, even though equity markets have recovered from initial shocks. Only this week another deadline of 1st August has been set and talks with many key partners such as China, EU and Canada continue. Consequently, uncertainty remains.

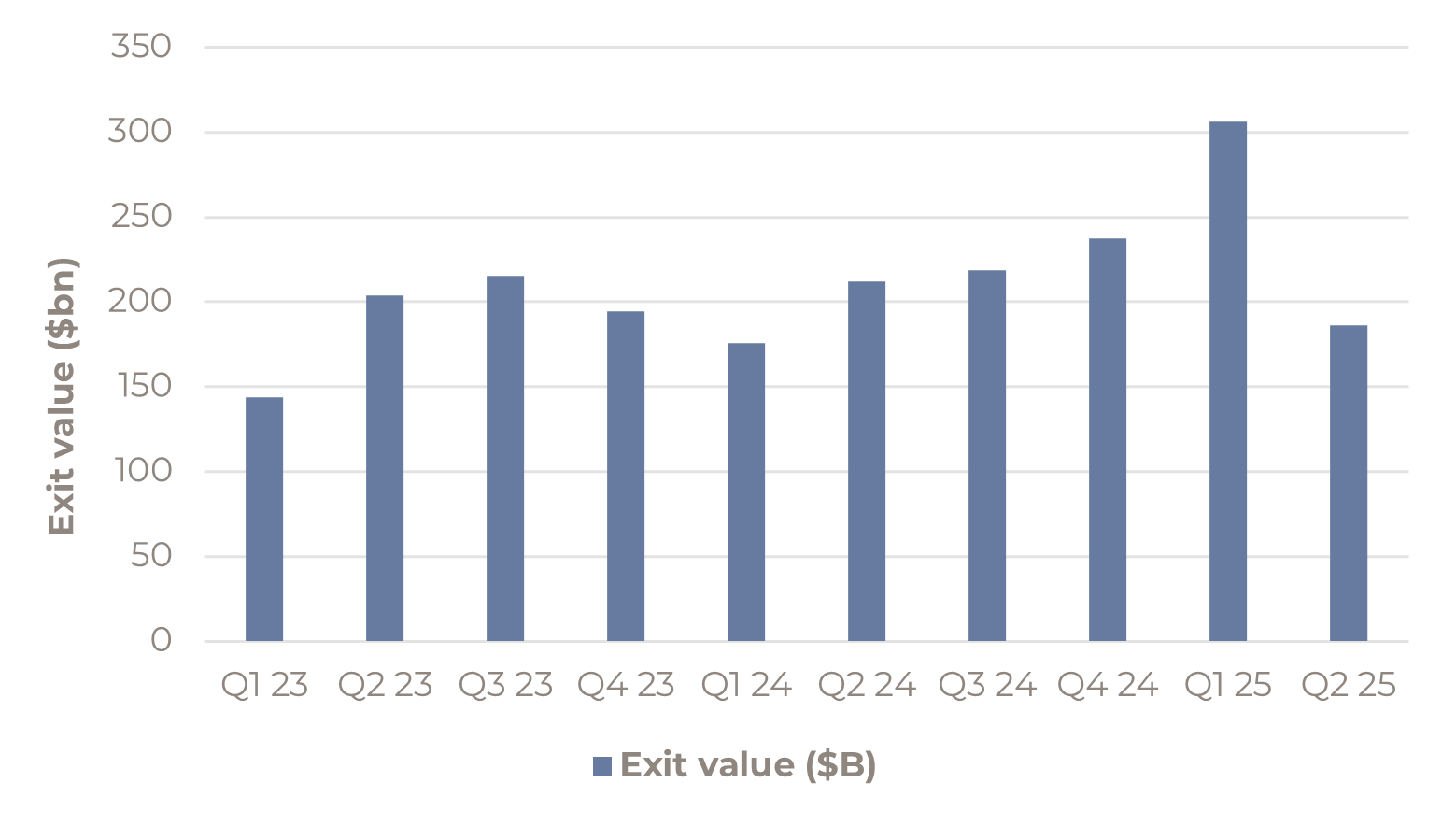

The impact of the unknown tariff position is clear to see in the exit data for global PE. This is the data showing the value of a PE firm’s investment being realised through the sale of a company they own to another investor. This could be to another company, another PE firm or through an Initial Public Offering (‘IPO’). Exit value had grown quarter-on-quarter throughout 2024 and continued into Q1 2025. The first quarter of 2025 was also an improvement on the same period in both 2023 and 2024 but post Liberation Day in Q2 2025, exits declined materially.

Global PE exit activity by quarter

Source: Pitchbook, Artorius

Exit liquidity: A problem

As a result of lower levels of M&A activity, exit liquidity has become a problem especially for private equity investors because capital raised from a business sale (or exit as it known) generates the investment return. Without the capital from an exit, there is less capital to re-invest and so the ecosystem loses liquidity. This has further been exacerbated by weaker IPO markets. Fewer companies have been listing on stock exchanges generally and Q2 2025 has seen many postpone listing due to market uncertainty.

Global IPOs

Source: Bloomberg, Artorius

London – are secondary listings the answer?

On a sidenote, London as a finance centre has been struggling to attract companies to list on the London Stock Exchange for a number of years, with just three IPOs this year according to Bloomberg. 10 UK companies have actually listed, which means the loss of seven listings to other stock exchanges or takeovers. So not just lower listings but also loss of market share to other exchanges too. We note just this week, the CBI, Britain’s biggest lobby group has published a report which highlights its belief that the London market’s best chances of revival could lie in attracting more secondary company listings. That is where a company lists its shares on two geographic stock exchanges to provide exposure to two investor bases.

Outlook: Better times ahead

We are hopeful that better market conditions for M&A markets lie ahead. It feels like we are getting closer to a definitive tariff situation in the US albeit posturing in public has continued this week The market just wants to know the new tariff level so it can price the impact on companies accordingly. The new August deadline is shorter than the previous 90 day deadlines so hopefully a resolution is closer. President Trump’s ‘Big Beautiful Bill’ is also now approved so that provides clarity on key areas such as corporate tax levels for example. Furthermore, inflation in developed markets is getting closer to target levels and so central bank interest rates could ease further. In turn, with economic stabilisation, businesses and investors may regain increased confidence to pursue strategic growth. Therefore, after a period of caution, dealmakers could become more active with access to cheaper capital and more valuation certainty. Whilst there are risks to this view, inflation from tariffs being our greatest concern, we do see reasons for optimism.

Phil Carroll

Head of Alternatives

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 10th July 2025 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20250710001