Looking back on Q3

Looking back on Q3

The first quarter of 2025 was MEGA with Europe leading the way as President Trump’s policies backfired on US stock markets and the US Dollar. The second quarter was all about the TACO trade as the President blinked (or maybe it was always the plan). By contrast the third quarter has been Golden, with broad based gains across markets reflecting pollyannaish optimism, although the strongest performer has been Gold itself, which is more synonymous with fear. What to make of it?

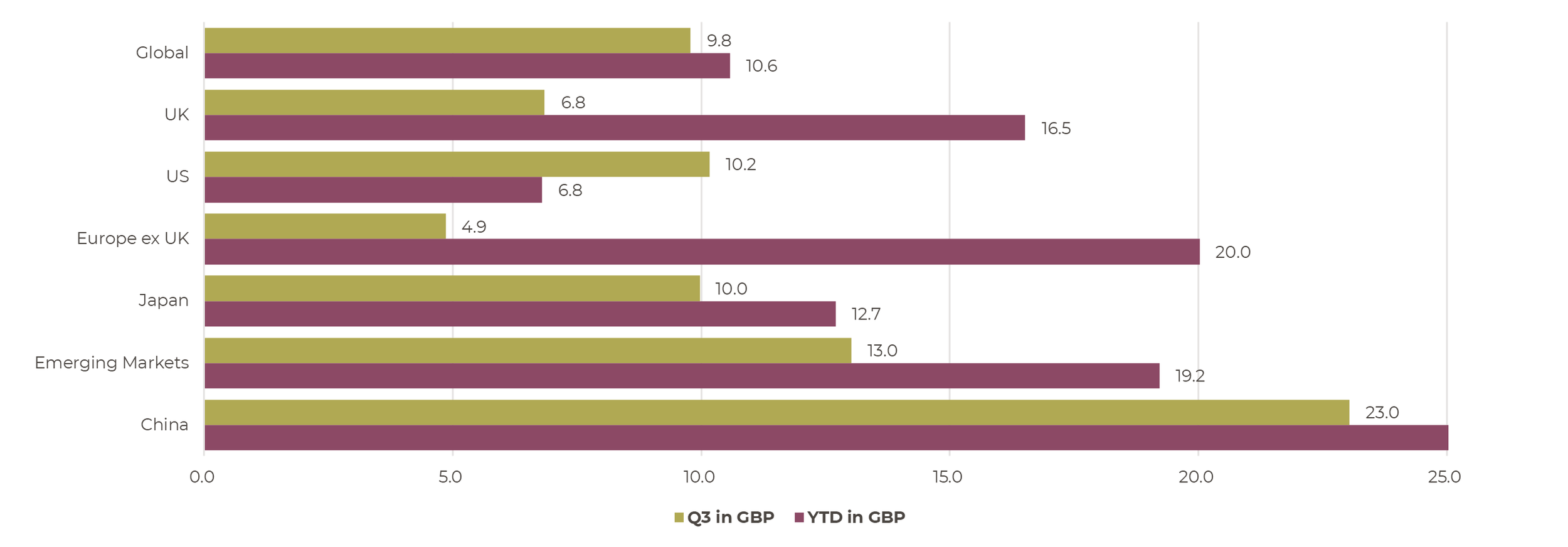

Global equities continue to perform strongly and September marked the sixth consecutive monthly rise as markets rebounded from the tariff-induced falls in April. In Sterling terms, Global equities rose 9.8% in the third quarter and are now in double digits for the year. Investor confidence has been boosted by interest rate cuts, with the US Federal Reserve (Fed) finally relenting and reducing rates - albeit not to the level that President Trump would like - and continued strength in corporate earnings, particularly in the AI sphere. While Fed Chairman Jerome Powell has tried to inject a note of caution (cutting rates is not a “risk-free path”), investors are more focused on weakening employment than stubborn inflation, and are looking beyond Powell’s term which ends in January 2026. When his terms ends he will be replaced by a new Chairman appointed by President Trump, who will presumably be more in favour of interest rate cuts.

With falling interest rates and robust earnings, markets look well supported despite high valuations. AI stocks are once again leading the market, but further returns may well be dependent on whether the huge levels of investment deliver commensurate returns to shareholders.

Equities were strong across all regions over the quarter with Emerging Markets leading the way

(Chart below shows percentage returns over the specified periods.)

Source: Artorius, Bloomberg

Indices used are: Global – MSCI All-Country World, UK – MSCI UK, US – S&P 500, Europe ex UK – MSCI Europe ex UK, Japan – MSCI Japan, Emerging Markets – MSCI Emerging Markets, China – MSCI China

As a reminder, all of these numbers are in GBP as that is the performance that matters to most of us based in the UK, and most of the underperformance of the US is attributable to significant weakness in the US Dollar, which has fallen by almost 10% this year against a basket of global currencies.

Europe continues to lead the way year-to-date but other regions are catching up. Emerging Markets have also been very strong, and in particular, Chinese equities have performed exceptionally and are up 32% this year.

Fixed Income continues to perform as expectations for further interest rate cuts increase

(Chart below shows percentage returns over the specified periods.)

Source: Artorius, Bloomberg

Indices used are: GBP Cash – Barclays Benchmark Overnight GBP Cash Index, UK Gilts – Bloomberg UK Government All Bonds, GBP Corporates – IBOXX Sterling Non-Gilts, Global Bonds – Bloomberg Global Aggregate Hedged GBP, Global High Yield – Bloomberg Global High Yield Hedged GBP, Emerging Markets Debt – Bloomberg EM Hard Currency Aggregate Hedged GBP

Fixed Income has also been broadly positive as the market focuses on central banks cutting interest rates and the prospect of further cuts to come. We are starting to see regional divergence, with Sterling bonds underperforming their global counterparts. The UK’s ongoing fiscal issues continue to dominate the headlines and it is expected that at November’s budget the Chancellor will need to implement further tax rises to restore her fiscal headroom. Bond markets are uneasy about the UK’s financial position (albeit other countries, not least France, have very similar if not worse issues) and this is keeping bond yields higher and prices correspondingly lower. Meanwhile in the US, markets expect further interest rate cuts as inflation is calm (albeit still above target) and there is considerable political pressure to make it happen. It remains unclear whether inflation will remain well behaved. There is notable tariff-led inflation in goods, but the larger services component is offsetting it. Over the quarter, higher risk bonds (High Yield and Emerging Markets) have outperformed reflecting the optimistic backdrop also seen in equity markets, but credit spreads remain tight versus history.

Dollar weakness is over (at least for now) while Gold outshines everything else

(Chart below shows percentage returns over the specified periods.)

Source: Artorius, Bloomberg

The Dollar Index compares the US Dollar to a basket of currencies. British Pound, Euro Yen, Gold and Oil are shown as performance versus the US Dollar. A spot rate is the current price at which an asset, like a currency or commodity, can be bought or sold for immediate delivery.

While the US dollar has been very weak this year, the weakness seems to be over for now, at least versus other major currencies. However, it is a very different story versus Gold, which continues to power ahead. A combination of expected interest rate cuts, continued concerns over major government debt/deficit levels, and persistent geopolitical uncertainties, has driven significant investor demand, which shows no sign of abating.

Will these trends continue into the fourth quarter?

Markets are resting on three legs: falling interest rates, robust corporate profits and an AI boom. While these remain in place, markets have scope to perform but equities and credit remain highly valued and political and geopolitical tensions persist.

Gareth Thomas, CFA

Head of Investment Management

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 3rd October 2025 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20251003001