UK energy prices – a headwind to growth?

UK energy prices – a headwind to growth?

As Autumn seeps into longer nights and cooler days, debates about lighting and heating rebound across UK homes.

We are struck by how electricity prices in UK have evolved compared to other developed countries. A simple base case view might be that the pattern is similar across all countries, especially in Europe. This seems to have been the case until 2004, but the subsequent period since has seen UK electricity rise dramatically.

The implications of how much is paid for energy has far reaching consequences as the cost of electricity impacts most aspects of everyday life, for businesses and consumers alike. It also impacts the cost base of UK plc through funding the country’s infrastructure and services. This all feeds through to help or hinder economic growth.

Domestic electricity price change over time by country (from 1979)

Source: Department for Energy Security & Net Zero (DESNZ, GOV.UK)

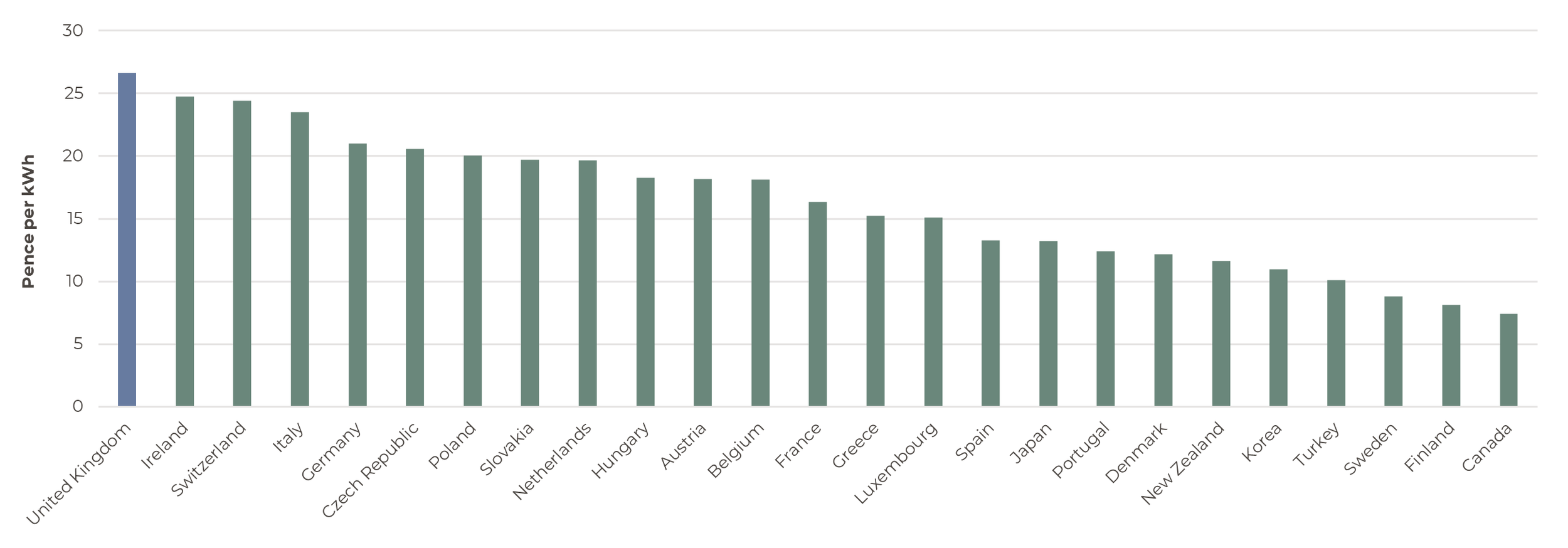

UK energy costs have risen considerably relative to its peers

UK domestic energy costs have risen considerably over the past two decades especially relative to other developed countries, both within Europe and further afield. To understand why this has been the case, we also need to look at the actual prices in terms of the starting point and where they are today.

Domestic electricity prices by country from 1979

Source: Department for Energy Security & Net Zero (DESNZ, GOV.UK)

Germany also feels the current cost burden

Interestingly, in absolute terms, the data suggests that Germany is also feeling the pain of high electricity prices in recent times. Domestic electricity prices in 2024 were in excess of 30p per kWh for both countries. Quite a contrast to France at just below 24p per kWh, so 22% lower than the UK. The country with the cheapest domestic energy cost in the most recent data is the US, at a staggering 58% cheaper than the UK.

UK Industry hit hard

Price statistics for electricity costs are provided for domestic and industrial customers separately. The domestic prices focus on the average price paid by households for their energy. This will be via a contract with an energy company that purchases its electricity from the wholesale market. Industrial prices relate to businesses and entities that are not households. Their electricity purchases can be complex, with some having contracts with an energy company like those with households and others acquiring energy from the wholesale market. Some also have renewable purchase power agreements in place which for example, is where a company would be contracted directly with a specific solar farm. In the industrial market, contracts are often long term with fixed prices. We would expect that in general, contracts for residential customers would be shorter on average than for industrial customers.

Industrial electricity prices by country for 2024

Source: Department for Energy Security & Net Zero (DESNZ, GOV.UK)

The UK no longer has a structural advantage

The evolution of the electricity price in the UK highlights that going into the 1980’s the UK had a very competitive position when it came to accessing cheap energy. Why would this be the case? Looking back, the benefit that enabled cheap electricity production in the UK was its access to low-cost domestic coal through its substantial coal mining industry. In addition, it also had access to North Sea Natural Gas following its discovery in the 1960s. This discovery began to change the mix in how the UK produced electricity. In essence, access to North Sea gas began the shift away from coal produced power.

Renewables have replaced coal

Over time, the structure of how the UK generates electricity has evolved. As the chart below shows, reliance on coal has effectively been replaced by renewables such as solar and wind. Nuclear still plays a role but has declined in terms of its percentage contribution. Most notable, is that the UK has been and remains, very reliant on natural gas.

Electricity generation capacity by source

Source: Department for Energy Security & Net Zero (DESNZ, GOV.UK )

Focus on gas drives higher prices

The UK continues to have a significant reliance on the use of natural gas to produce electricity. This is one of the key reasons why electricity prices are high domestically. It is a result of the fact that the wholesale electricity market uses what is called the "marginal pricing" system. This system uses a mechanism that dictates that the cost of all electricity supplied to the grid is set by the most expensive power source needed to meet demand at any given time, which is frequently a gas-fired power plant.

The UK is not alone in this approach as Germany operates a similar system and has a reliance on natural gas. Germany also imposes a material level of taxes and surcharges, in part to support development of the power grid.

Is a high energy cost an economic headwind?

The high electricity costs experienced in the UK, relative to many of its international peers suggests it is likely to be a headwind to economic growth and business competitiveness. Strategic decisions at a governmental level on reducing the nation’s reliance on coal and investing in renewables make sense in the need to tackle climate change. This is despite an incremental transitional economic cost. However, targeting net zero aside, it would seem that a strategic focus on looking how to structurally reduce energy costs for the country in the future might be worth considering. A review of the pricing system might be a good place to start.

Phil Carroll

Head of Alternatives

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 10th October 2025 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20251010001