Resilience in the face of noise

Resilience in the face of noise

Summary

Equity markets have enjoyed a period of good returns across most regions and sizes. The breadth of the rally suggests that better-than-expected economic data and improving profits have pushed the noise of geopolitical tensions out of mind for investors.

Profits have continued to climb, both in the US and around the world, as the effects of easing interest rates and a period of relative calm have supported economic recovery globally. Even within the US equity market, the rally has been widespread across the size spectrum, indicating that investors are willing to believe in stronger economic growth for 2025 and 2026, following a period of recessionary fears induced by President Trump’s tariff announcements in April.

The US dollar remains weak, albeit from a multi-year high. If this continues then this may provide further support for non-US equities. A weak dollar is normally associated with stronger equity returns from non-US equities in comparison to US equities.

Chairman Powell, the head of the US Federal Reserve, is set to retire in May 2026. President Trump is likely to propose a new Chairman in the coming months, who is likely to be more inclined to cut interest rates, especially as this is a stated aim of the Trump administration. Investors may end up listening to the guidance provided by whomever Trump proposes, rather than Powell, to assess the path of monetary policy in 2026. Whilst the prospect of lower interest rates may well be supportive for US economic growth, the overt political interference in monetary policy could damage the credibility of the Federal Reserve and lead to further weakness in the US Dollar.

Markets appear to have discounted the potential impact of tariffs. Whether this reflects a belief that President Trump will eventually be unable to impose his tariff threat or that the tariffs will be absorbed by the economy is uncertain. Over the weekend of 12th July, President Trump reignited the tariff rhetoric with further threats against Europe. It is striking that bonds and equities didn’t react to the rhetoric, which if enacted would be damaging to global trade and the wider global economy.

Double digit days

A striking feature of the past few months has been the widespread calm and progress of equity markets, despite tariffs and middle east military tensions. Most regional equity markets have recorded returns in excess of 10% since mid-April. The quiet rise of equities suggests that despite the news flow and geopolitical tensions, investors are sanguine about risk.

Most equity markets have delivered double digit returns over the past 3 months despite the geopolitical backdrop

Source: Bloomberg, Artorius

The backdrop for the robust equity markets is based on the continued rise in corporate earnings per share (EPS)

Source: Bloomberg, Artorius

In the US, the recovery of the large technology stocks has helped the S&P 500 reach record highs. However, the S&P 400 and S&P 600, the mid and small company indices respectively, returned 12% and 14%, highlighting that whilst the technology companies may be taking the ‘plaudits’ the wider US equity market has also climbed higher.

In our view, the resilience in equities is based on the earnings base that continues to improve. The chart shows earnings per share (EPS) in US Dollars for both US equities (as represented by the S&P 500) and non-US equities (as represented by the MSCI World ex US index).

Resilience of profits is key. In the absence of an economic shock, i.e. a recession or further disruptive policy announcements from President Trump, the backdrop appears to be supportive for further progress of equities.

A better economic mix

Economists, like weather forecasters, are expected to provide predictions. The chart to the right shows the consensus prediction for US economic growth and inflation in 2025 made by economists through the past two years. In the case of the US, forecasts for economic growth for 2025 were raised through the second half of 2024. Expectations for US economic growth in 2025 moved from a subdued pace of 1.5% to over 2% by the end of 2024.

Post the announcement of tariffs in early April, expectations for economic growth in 2025 were cut quite sharply. We note that the cuts have now stopped and there are some signs of a better outlook for US economic growth, even though these estimates are still lower than at any point over the past two years. We see a similar picture for other regions. Maybe the prospects for the global economy have stopped getting worse, and that is good news given the worst-case scenario under Trump’s initial tariff plan in April.

In addition to the slight improvement in the economic growth outlook, the inflation forecast has eased in recent months. Over time, when the inflation outlook is improving and economic growth forecasts rising, equities tend to be resilient.

Forecasts for US economic growth and inflation for 2025 have improved in recent weeks, slightly stronger growth and lower inflation which is a better mix for investors

Source: Bloomberg, Artorius

US dollar

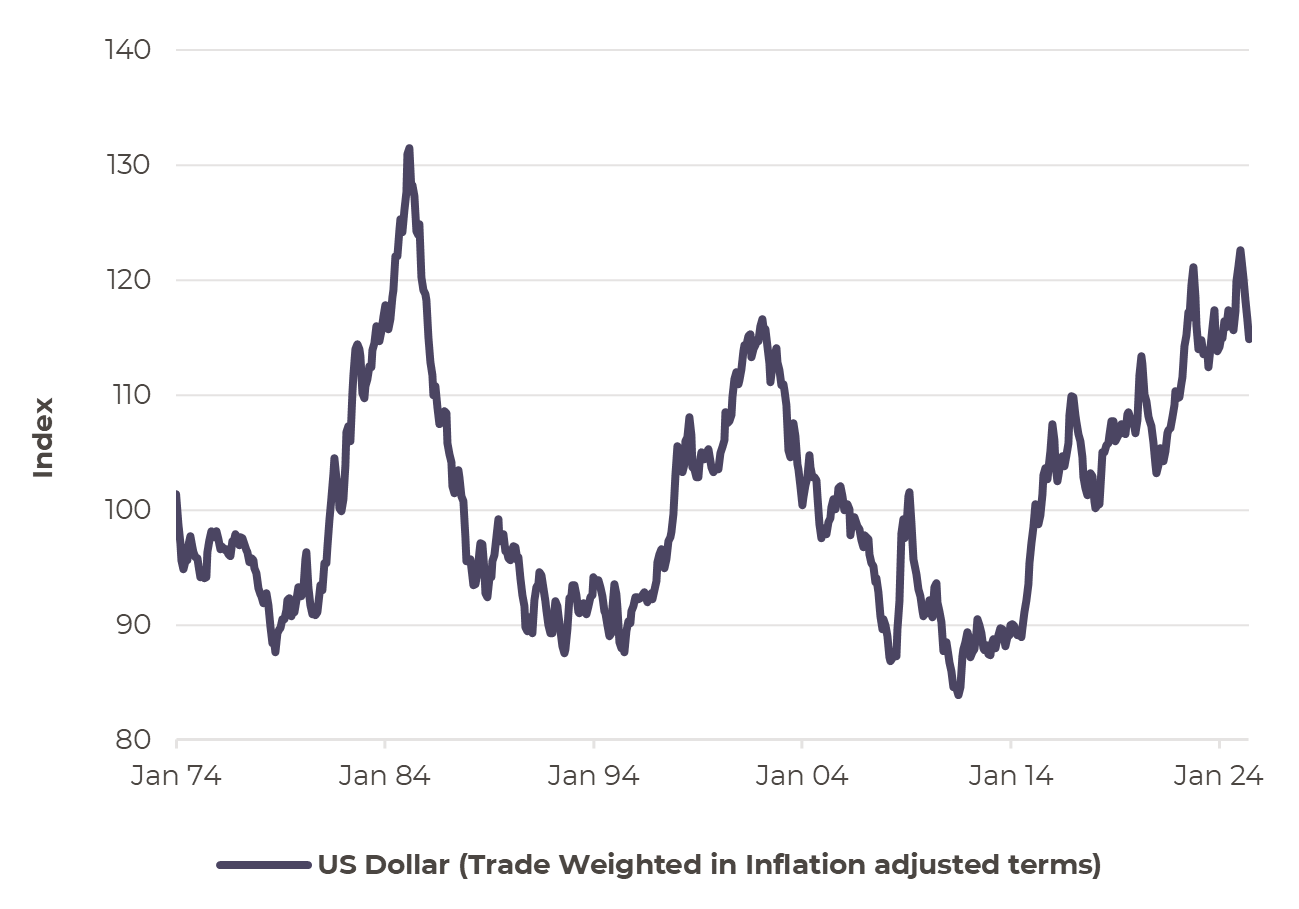

The US Dollar has fallen 7% since the end of January 2025 against a basket of other currencies. Much of this weakness has been against the Euro which has risen 15%. This erosion of the US Dollar value reflects a change in perception of the attractiveness in holding US assets. However, it is worth noting that the level of the US Dollar remains high when compared to the past 45 years. It is not clear what view the Trump’s administration has of the US Dollar.

The US has run a trade deficit for a considerable period, suggesting that the US Dollar has been too strong for too long. Other economies have in effect benefited from this deficit, as, in aggregate, they have sold more to the US than the US has bought from them.

The weakening of the US Dollar is supportive of non-US equities. Historically when the US Dollar weakens on a sustained (multi-year) time frame, non-US equities outperform US equities.

The US Dollar has eased back 7% in recent months but remains towards the high level when viewed in the context of the past 45 years.

Source: Bloomberg, Artorius

Serious but not literal

A new Chair and lower interest rates?

The Chair of the Federal Reserve, Jerome Powell, is due to step back from being head of the interest rate setting body in May 2026. President Trump is vociferous in calling for Powell’s departure and for the Federal Reserve to cut interest rates.

Whilst Powell seems determined to stay in office until May 2026, President Trump may propose a new Chair ahead of the completion of Powell’s term in office. It is likely that the new Chair will be more inclined to support lower interest rates, as this fits the desires of President Trump. In terms of market credibility, investors may end up listening to the guidance provided by whomever Trump proposes, rather than Powell, to assess the path of monetary policy in 2026.

Lower interest rates may stimulate stronger economic growth and a better backdrop for earnings but are likely to erode the value of the US Dollar, especially in the face of overt political interference in monetary policy decision making.

On Saturday 12th July, US President Donald Trump threatened to impose 30% tariffs on imports from the European Union and Mexico, capping a week in which he went back on the offensive in trade negotiations. In a social media post, the President described the US’s trade deficit as a risk to national security. Most economists would view the deficit as a sign that the U.S. economy is uncompetitive - either because the US Dollar is too strong or because the US doesn't produce enough goods that are in demand globally. The rest of the world buys Apple phones, but these are not made in America despite Apple being an American company. Ownership and design may be American (as are the profits) but the product isn’t American in the way that the trade data measures it.

The escalation in trade tensions comes after the expiration on 9th July of a 90-day pause on most of the “Liberation Day” tariffs announced by the White House on 2nd April. There was a steady stream of trade threats through the week, starting with the delivery of a batch of letters to 14 nations announcing that higher tariffs would be introduced on 1st August unless further concessions were made. The administration also indicated it would implement a 50% tariff on copper imports, along with duties of up to 200% on pharmaceuticals entering the US.

This flurry of announcements may reflect an emboldened President Trump. He may believe that the rally in the equity market shows that the market either doesn’t believe him or that the economy can withstand his policy. We would suggest that imposing tariffs on the scale announced over the weekend of the 12th July would disrupt the sanguine backdrop for markets.

It appears that President Trump maybe be serious about imposing tariffs, but markets have stopped taking him literally.

Conclusion

*Any feedback provided can be anonymous

Equity markets have enjoyed a period of good returns across most regions and sizes. The breadth of the rally suggests that better-than-expected economic data and improving profits have pushed the noise of geopolitical tensions out of mind for investors.

Profits have continued to climb, both in the US and around the world, as the effects of easing interest rates and a period of relative calm have supported economic recovery globally. Even within the US equity market, the rally has been widespread across the size spectrum, indicating that investors are willing to believe in stronger economic growth for 2025 and 2026, following a period of recessionary fears induced by President Trump’s tariff announcements in April.

The US dollar remains weak, albeit from a multi-year high. If this continues then this may provide further support for non-US equities. A weak dollar is normally associated with stronger equity returns from non-US equities in comparison to US equities.

Chairman Powell, the head of the US Federal Reserve, is set to retire in May 2026. President Trump is likely to propose a new Chairman in coming months, who is likely to be more inclined to cut interest rates, especially as this is a stated aim of the Trump administration. Investors may end up listening to the guidance provided by whomever Trump proposes, rather than Powell, to assess the path of monetary policy in 2026. Whilst the prospect of lower interest rates may well be supportive for US economic growth, the overt political interference in monetary policy could damage the credibility of the Federal Reserve and lead to further weakness in the US Dollar.

Markets appear to have discounted the potential impact of tariffs. Whether this reflects a belief that President Trump will eventually be unable to impose his tariff threat or that the tariffs will be absorbed by the economy is uncertain. Over the weekend of 12th July, President Trump reignited the tariff rhetoric with further threats against Europe. It is striking that bonds and equities didn’t react to the rhetoric, which if enacted would be damaging to global trade and the wider global economy.

Important Information

Artorius provides this document in good faith and for information purposes only. All expressions of opinion reflect the judgment of Artorius at 18th July 2025 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results.

Nothing in this document is intended to be, or should be construed as, regulated advice. Reliance should not be placed on the information contained within this document when taking individual investment or strategic decisions.

Any advisory services we provide will be subject to a formal Engagement Letter signed by both parties. Any Investment Management services we provide will be subject to a formal Investment Management Agreement, which will include an agreed mandate.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20250717001