A turning tide

A turning tide

Summary

After a long January filled with President Trump’s threats to Greenland and Venezuela, February appears to have ushered in a more stable backdrop, to date. Whilst the US is building up forces close to the Persian Gulf, with an implicit threat to Iran, it feels like there has been a quietening of geopolitical tantrums, which has been welcomed by investors.

Interest rate cuts, monetary policy nudges by the White House and fiscal stimulus are likely to see stronger economic growth in the US. And despite the improving backdrop in the US, the US Dollar continues to fall. Some would link this to the ‘risk’ that Trump presents to US credibility, but the cause may be linked to bond yields and interest rates.

US bond yields have seen their premium over other government bond markets ease over the past year. US bond yields have fallen by more than other major markets since the start of 2025, which is a fundamental (economic/financial) reason for the US Dollar to have fallen 11%.

Historically, when the US Dollar has fallen then emerging market equities have tended to outperform global equities in general. Fuelled by the rise in earnings, the emerging market equity market has been a beneficiary of the strength in technology, as its leading constituents are technology giants of Taiwan and South Korea.

Technology trends are also being reflected in the commodity market. The likes of copper, regarded as a key indicator of economic health, has seen a surge in demand as electrification and infrastructure spending on information technology, such as data centres, has risen sharply in price. Technology shares in the US may be taking a breather in driving markets, but technology trends continue to be felt across emerging markets and commodities.

US Dollar

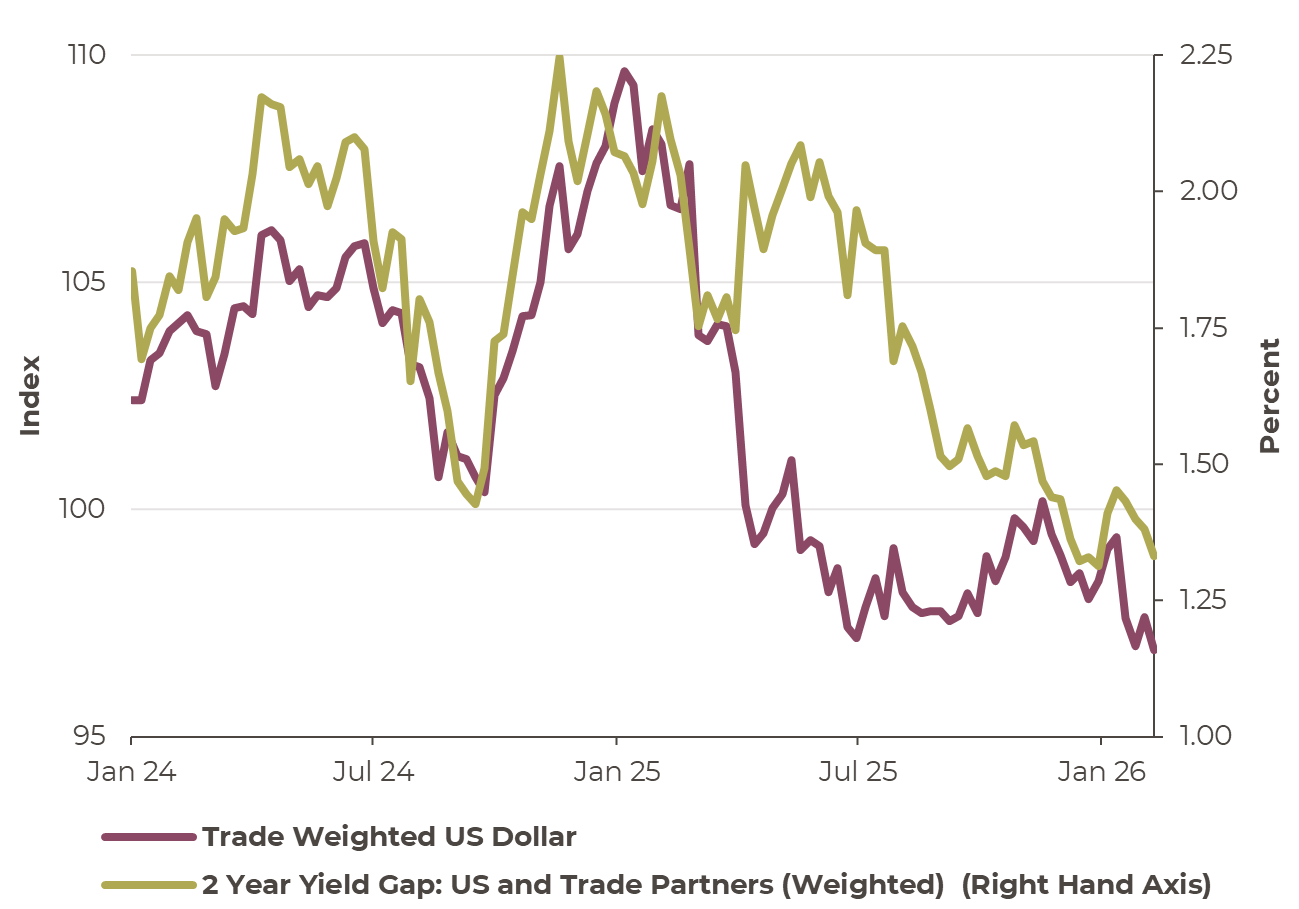

For some the fall in the US Dollar can be linked to the actions of President Trump towards Greenland, Iran and the intervention in Venezuela. Since President Trump came to power in January 2025 the Trade Weighted US Dollar has fallen 11.6%. In the chart to the right, the path of relative interest rates can be seen together with the Trade Weighted US Dollar. The latter tracks the value of the US Dollar against the basket of major currencies of ‘advanced’ economies weighted by the amount of trade a particular country has with the US.

Whilst President Trump may be a challenge to political norms, we would suggest that the path of the US Dollar is being driven by the economic norms. And for the fans of the 1980s sitcom ‘Cheers’, Norm is good.

The 2-year yield gap shows the difference in yields between the US and other countries’ 2-year bond yield. The yields of Europe, UK, Japan, Canada, Sweden and Switzerland have been weighted in line with the weighting in the US Dollar index. At the start of 2025, the 2-year US bond yield was 2.25% higher than its international peers and the US Dollar was around 110. In recent weeks, the US Dollar has fallen to 97 whilst the yield gap has fallen to 1.33%.

It is noticeable that the US Dollar fell so sharply in the early half of 2025, despite relatively high US bond yields. This corrected as US bond yields fell relative to other bond yields. But the 2025 gap in the relationship may speak to how markets viewed the US Dollar (and the US government) in light of the actions of President Trump. The fall of the US Dollar, and the increase in the price of ‘safe havens’ such as gold and the Swiss Franc in the same time frame may indicate a change (a collapse) in confidence in the US Dollar.

The value of the Trade Weighted US Dollar appears to be linked to relative bond yields

Source: Bloomberg, Artorius

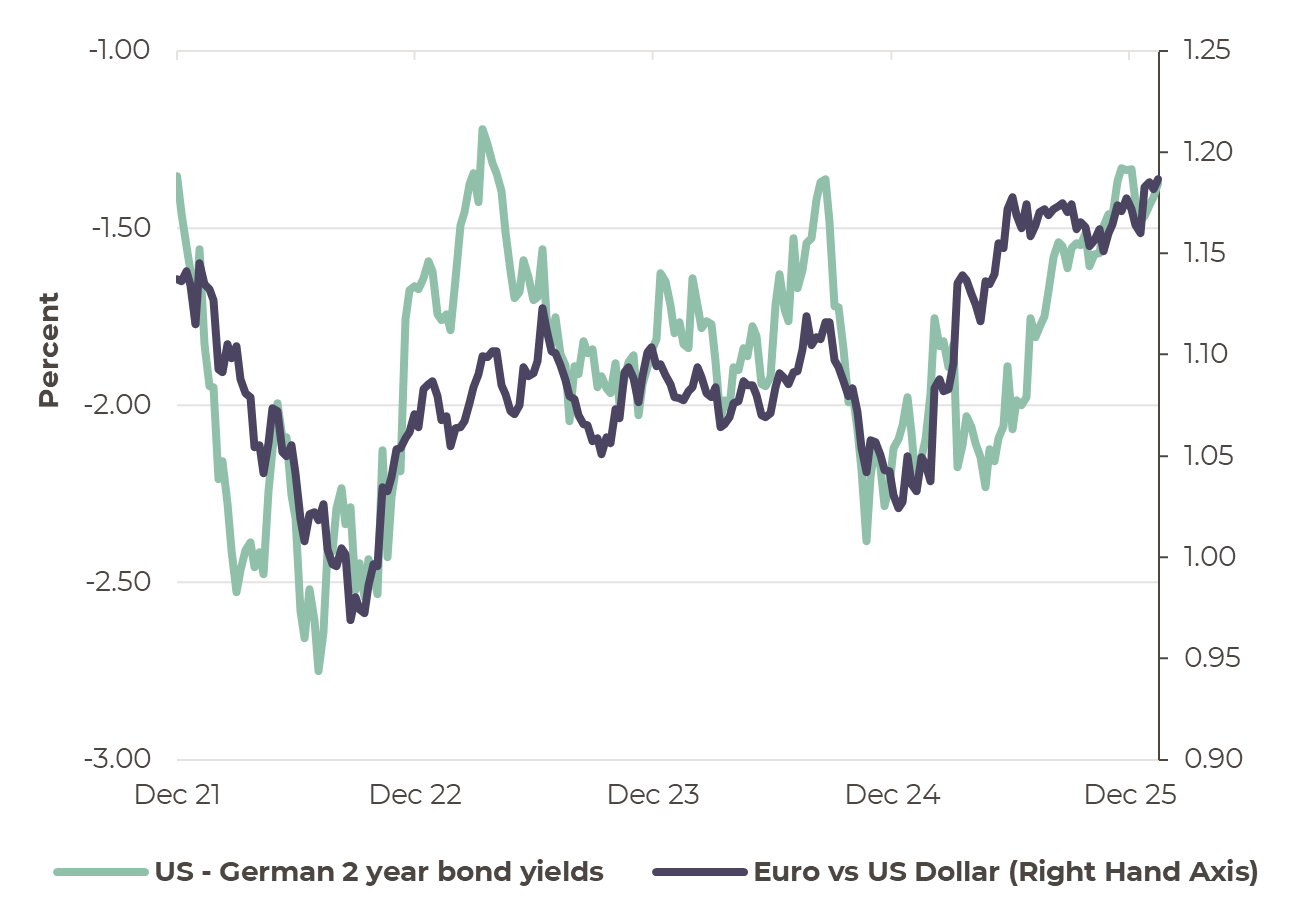

When examined over a longer time frame the relative interest rate (or bond yield) and currency relationship can be observed in the Euro and US Dollar.

The chart to the right shows the relative 2-year yield (where US yields have been higher than Germany’s) through the 2020s. At the end of 2024, the US 2-year yield was around 2% higher than Germany’s. Through 2025, as Germany loosened its fiscal stance (meaning that its bond yields rose in comparison to the US’s) the yield gap has narrowed to 1.2%. Over the same time frame the Euro rose from $1.03 to $1.18 (a 14.5% increase in the Euro against the US Dollar).

With President Trump seeking lower interest rates from his new head of the Federal Reserve, the US Dollar may see continued weakness as the interest rate premium continues to be reduced. This may especially be the case if other regions of the global economy enjoy economic growth as seems to be the case at the start of 2026.

German and US bond yield gap and the value of the Euro versus the US Dollar appears to be highly correlated

Source: Bloomberg, Artorius

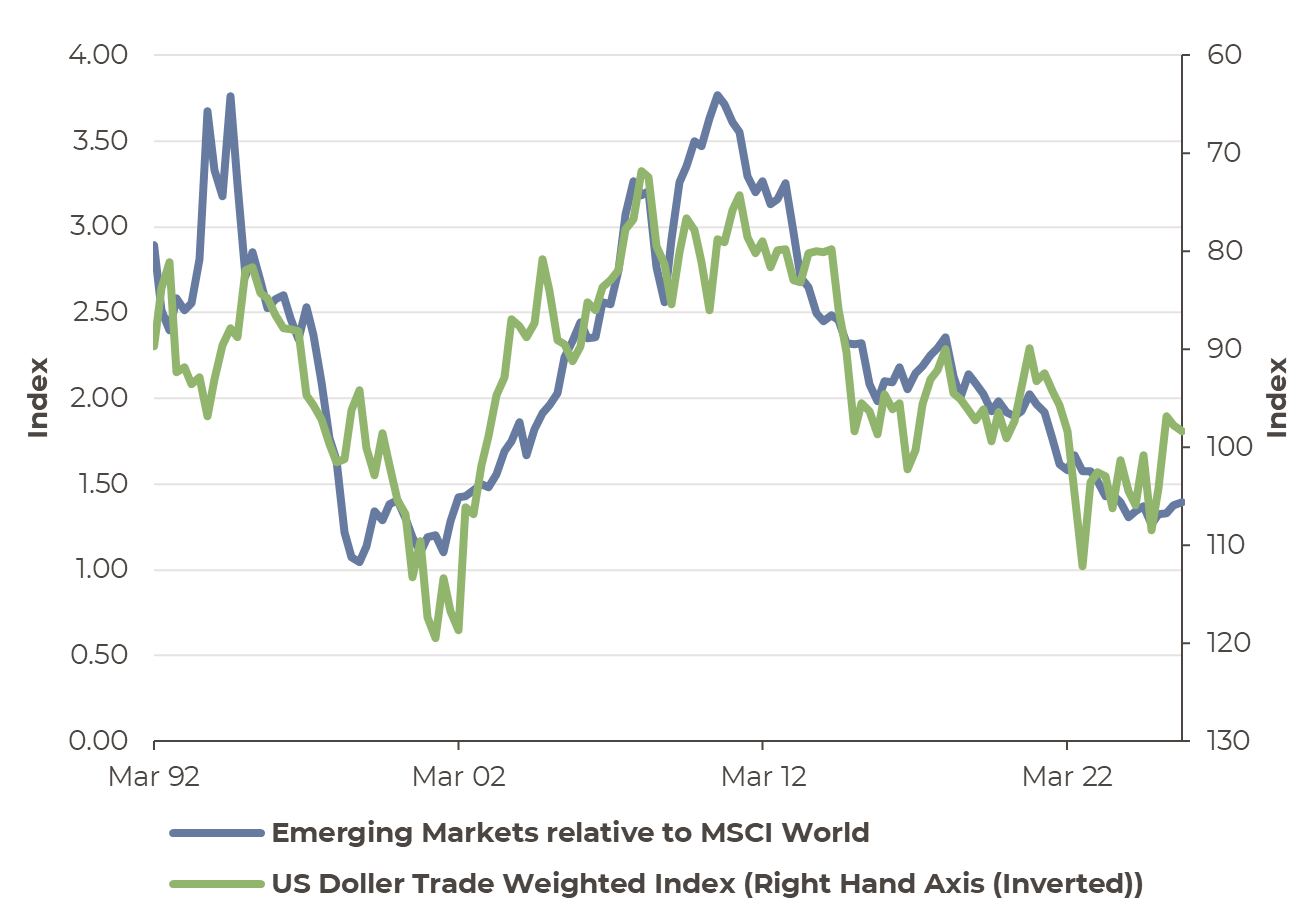

A quiet bull market

The fall in the US Dollar is benefitting emerging market equities. There is a long relationship between the strength of the US Dollar and the relative fortunes of emerging markets. Periods of strength for the US Dollar have been associated with periods of underperformance of emerging markets relative to global equity markets.

After underperforming for over a decade, the emerging markets have started to outperform the global equity market.

And whilst the US Dollar could be seen to be external to emerging markets, the underlying backdrop for emerging market equities is supportive. The rise in emerging market earnings is continuing to reflect the strength in economic activity linked to the technology giants of Taiwan and South Korea.

Emerging market equity relative performance and US Dollar

Emerging market equity index and Earnings Per Share (EPS)

Source: Bloomberg, Artorius

Source: Bloomberg, Artorius

King Copper?

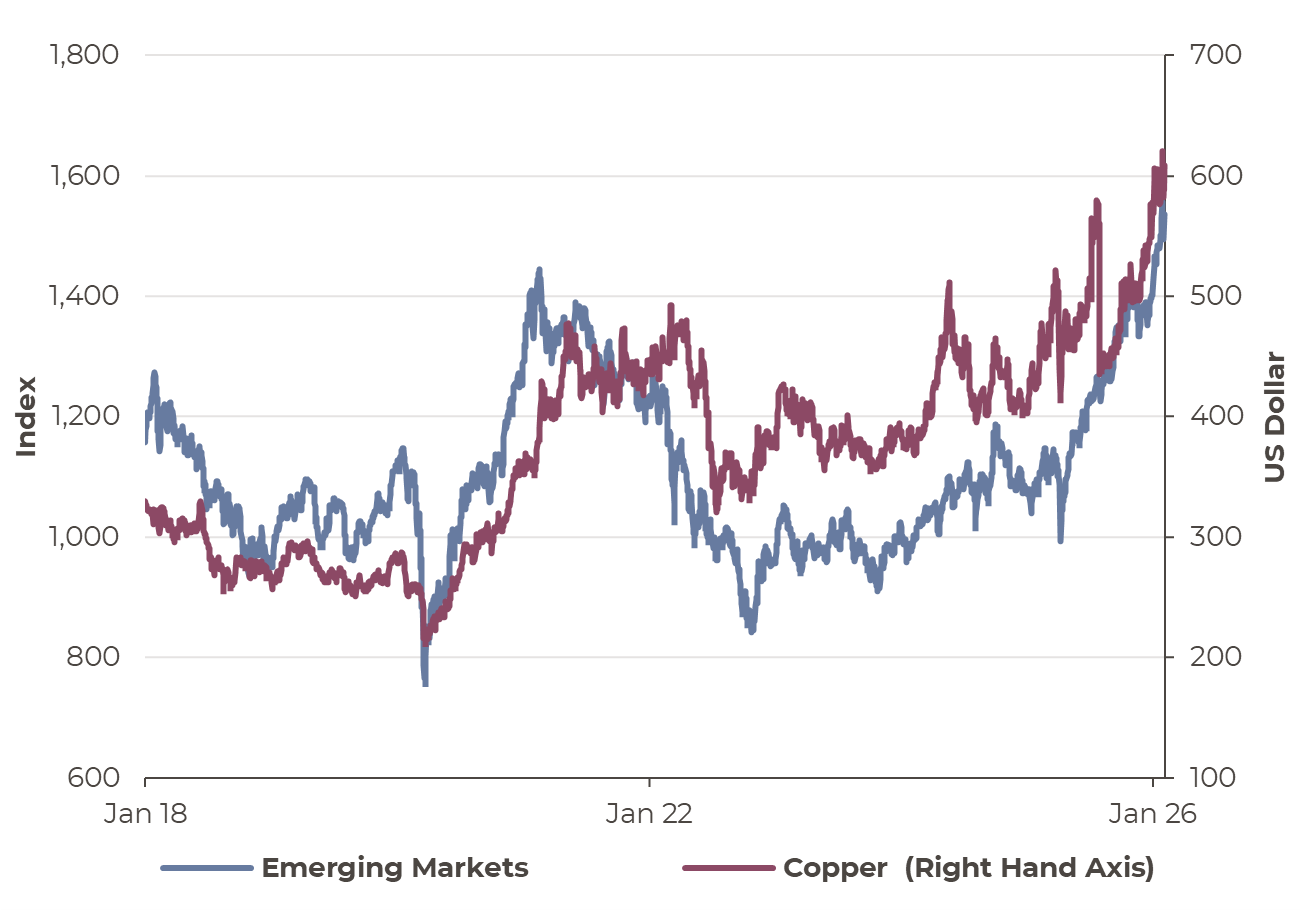

The technology story is also being observed in the commodity universe, especially copper. Copper has exceptional electrical and thermal conductivity. This makes it indispensable in a wide range of industrial and consumer applications, and its role in the electrification and decarbonisation of the global economy is foundational. Its excellent conductivity, corrosion resistance, and versatility make it the preferred material for electrical wiring, motors, transformers, and power infrastructure. The shift to electric vehicles (EVs) has dramatically increased copper demand—EVs use roughly 2–4 times more copper than internal combustion engine vehicles—and renewable energy systems such as wind and solar and grid upgrades require substantial copper inputs for cables, substations and transmission lines.

More recently, the accelerating build-out of data centres and AI infrastructure is a rising source of demand as these facilities demand large quantities of copper for power distribution and connectivity. These trends collectively underpin projections of significant long-term growth in copper consumption as electrification accelerates across sectors.

The fate of copper and emerging markets appears closely aligned, as they both reflect the dominance of technology in equity markets and the acceleration of demand for the commodity.

Years of chronic underinvestment have left global copper mine capacity stretched to its limits and there have been a number of notable supply disruptions over the last year across Chile, Congo and Indonesia, leaving little slack to absorb surging demand. Bringing on supply is rarely quick as mines typically have long lead times, which limits the ability to increase production. Copper miners seem more focused on M&A activity than expanding production, with significant consolidation in the industry, most notably an agreed merger between Anglo-American and Teck Resources to create a new global copper mining giant. With continued demand from electrification and AI capital expenditure likely to keep growing, further price gains are likely, unless the macro outlook deteriorates.

Emerging market equity index and copper price

Source: Bloomberg, Artorius

A change in leadership

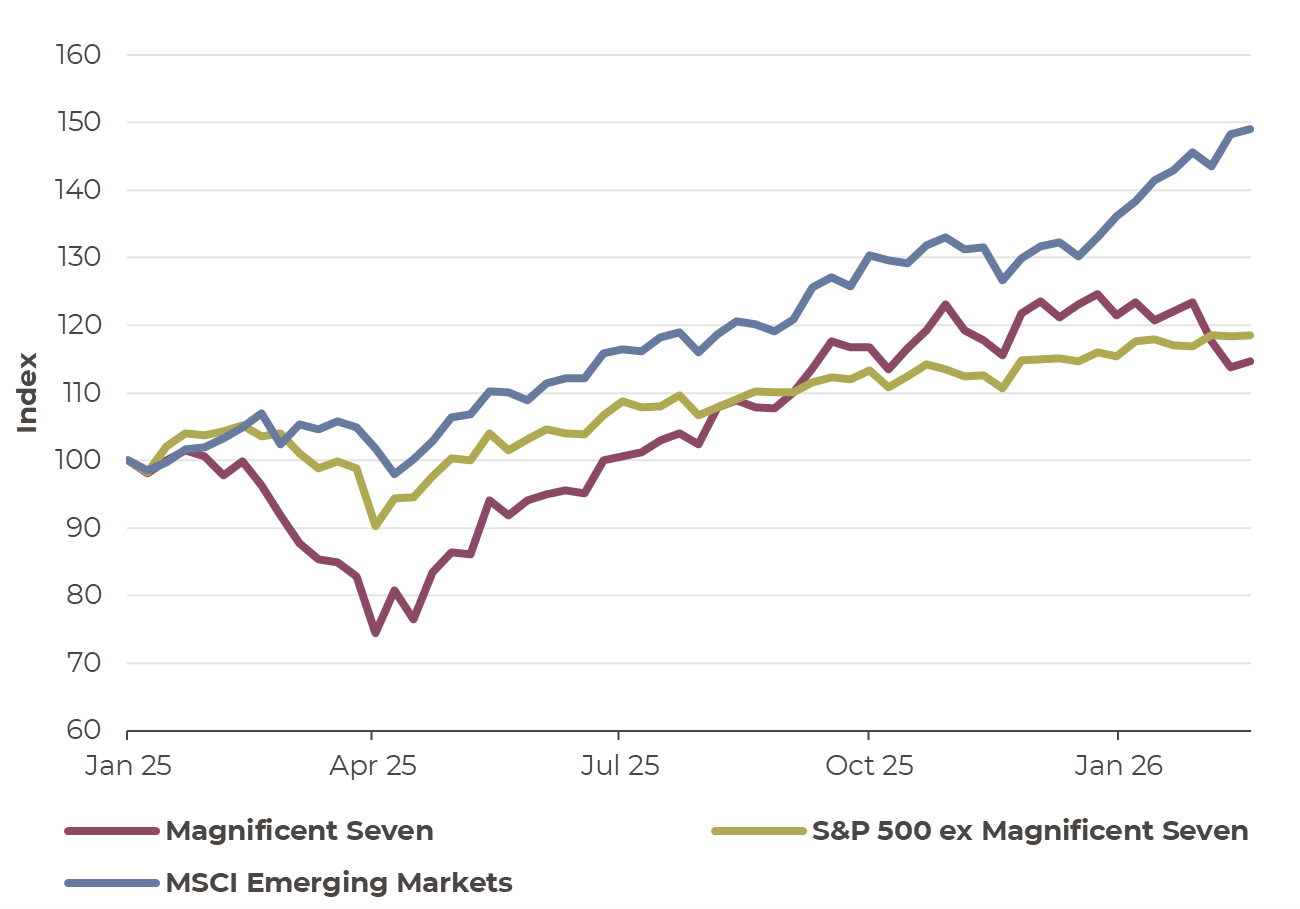

Whilst the strength in technology is benefitting the likes of emerging market equities and copper, the technology giants of the US are taking a pause for breath. The so-called Magnificent Seven index (the likes of Amazon, Google, Meta etc.) has fallen 9% since its highs in December 2025 (after a volatile 2025). Whilst the US S&P 493 (the S&P 500 excluding the Magnificent Seven) is at its highs, so to is the emerging markets equity market.

This slipping of the technology giants in the US is despite relatively good earnings updates and may reflect investor scepticism over the future profitability of the current spending on Artificial Intelligence. That spending may be fuelling the rise in copper prices and the profits of Taiwanese and South Korean companies such as TSMC and Samsung, but appears to be cooling the ardour for US technology by investors.

Technology winning but just not in the US

Source: Bloomberg, Artorius

Conclusion

After a long January filled with President Trump’s threats to Greenland and Venezuela, February appears to have ushered in a more stable backdrop, to date. Whilst the US is building up forces close to the Persian Gulf, with an implicit threat to Iran, there feels like there has been a quietening of geopolitical tantrums, which has been welcomed by investors.

Interest rate cuts, monetary policy nudges by the White House and fiscal stimulus are likely to see stronger economic growth in the US. And despite the improving backdrop in the US, the US Dollar continues to fall. Some would link this to the ‘risk’ that Trump presents to US credibility, but the cause maybe be linked to bond yields and interest rates.

US bond yields have seen their premium over other government bond markets ease over the past year. US bond yields have fallen by more than other major markets since the start of 2025, which is a fundamental (economic/financial) reason for the US Dollar to have fallen 11%.

Historically, when the US Dollar has fallen then emerging market equities have tended to outperform global equities in general. Fuelled by the rise in earnings, the emerging market equity market has been a beneficiary of the strength in technology, as its leading constituents are technology giants of Taiwan and South Korea.

Technology trends are also being reflected in the commodity market. The likes of copper, regarded a key indicator of economic health, has seen a surge in demand as electrification and infrastructure spending on information technology, such as data centres, has risen sharply in price. Technology shares in the US may be taking a breather in driving markets, but technology trends continue to be felt across emerging markets and commodities.

*Any feedback provided can be anonymous

Important Information

Artorius provides this document in good faith and for information purposes only. All expressions of opinion reflect the judgment of Artorius at 20th February 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results.

Nothing in this document is intended to be, or should be construed as, regulated advice. Reliance should not be placed on the information contained within this document when taking individual investment or strategic decisions.

Any advisory services we provide will be subject to a formal Engagement Letter signed by both parties. Any Investment Management services we provide will be subject to a formal Investment Management Agreement, which will include an agreed mandate.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20260220001