Too SaaSy?

Too SaaSy?

Whilst the AI (‘Artificial Intelligence’) growth story is no longer new news, the rate and impact of its development appeared to have reached a new level earlier this month. This is evidenced in the Software-as-a-Service (‘SaaS’) sector where it experienced a notable selloff last week, erasing approximately $285-300 billion in market value. The driver being the latest product launch from one of the leading AI companies. This has led to the question: Are we seeing a SaaSpocalypse?

Anthropic launches automation tools in the legal software market

Anthropic, one of the largest AI companies globally, based in the US, released new workflow automation plugins on 3rd February for its digital tool - Claude Cowork. It is an AI workplace assistant that enables automation in a number of legal areas such as contract review and compliance tracking. It didn’t take long for investors to take the view that if Anthropic could disrupt the legal software market, then AI was likely to also disrupt other software sectors.

Major SaaS companies take a hit as market senses broader implications

Following the update from Anthropic, several listed companies in the legal/professional services sector saw double digit share price declines including Thomson Reuters, LegalZoom and RELX. Notably, Thompson Reuters has its own AI legal tool product called CoCounsel which in part uses Claude, the Large Language Model (‘LLM’) of Anthropic, suggesting Anthropic is willing to compete with its existing customers. The sell-off was not limited to the legal sector as the market quickly came to the conclusion that the implications were broader and other SaaS sector companies including Salesforce, Docusign & Adobe also saw material adverse share price moves.

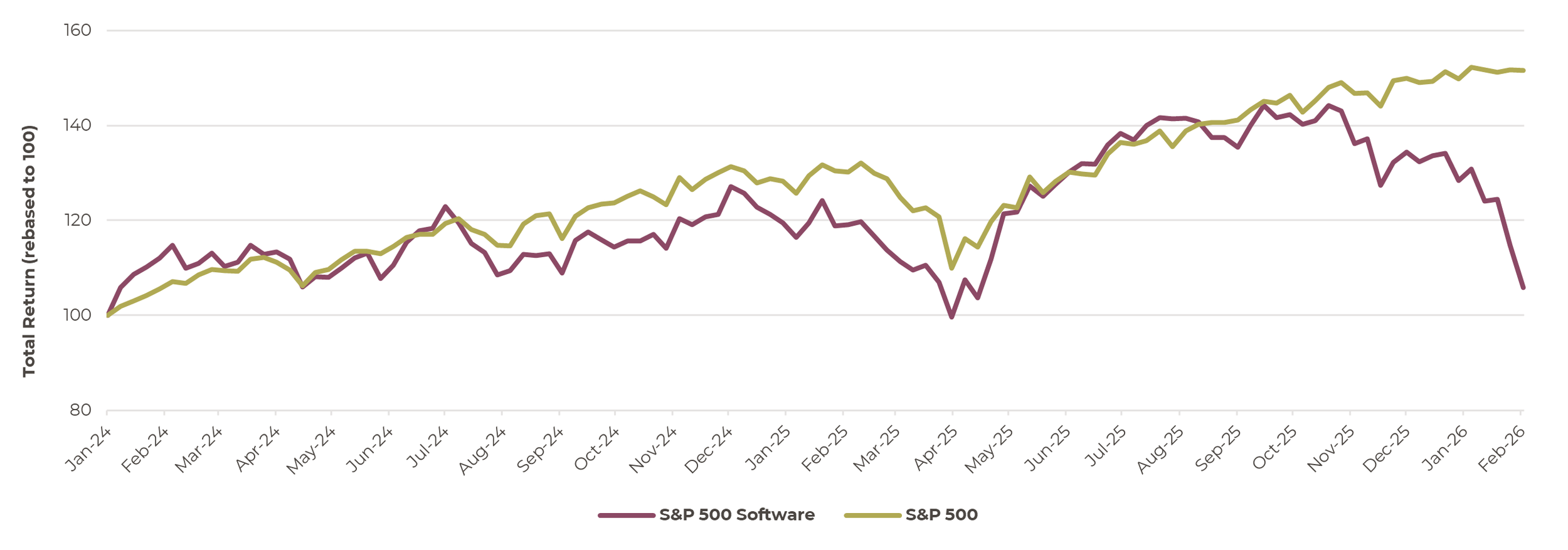

S&P 500 Software sector vs S&P 500

Source : Artorius, Bloomberg.

The recent sell-off was the continuation of a theme

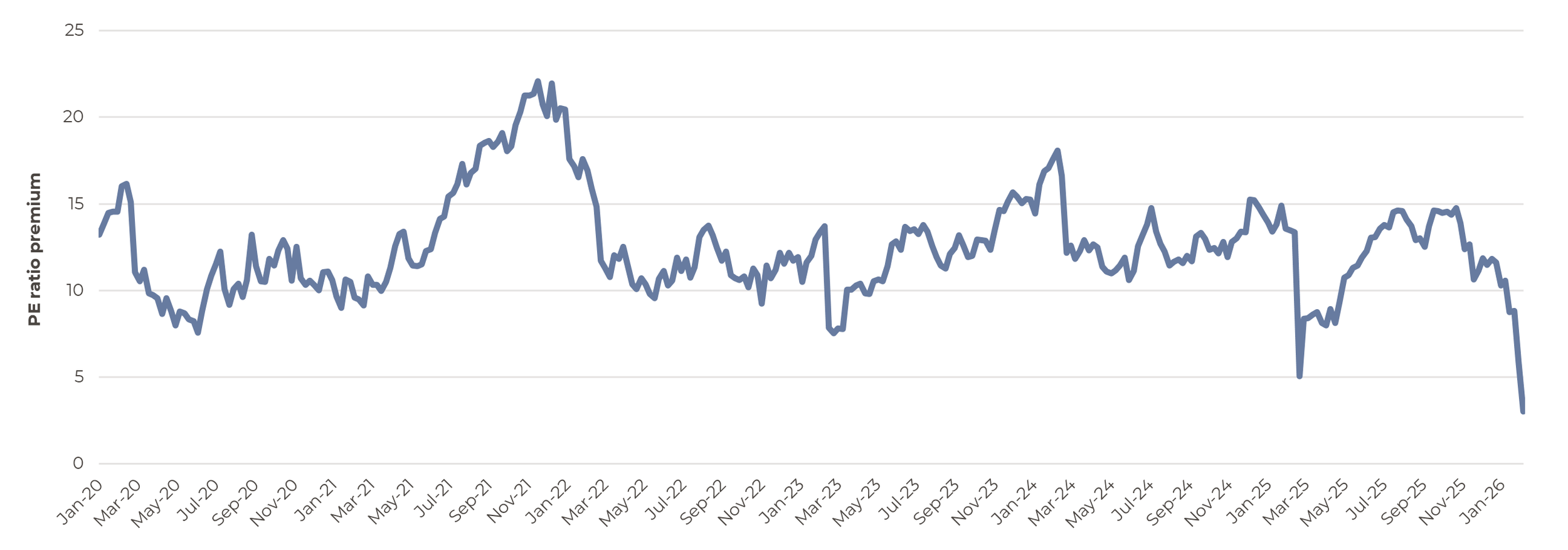

The chart above shows how the S&P 500 Software sector has performed relative to the S&P 500 as a whole since 2024. As can be seen, whilst there was a sharp sell-off in the software sector post Anthropic’s new product release, it is arguably more the continuation of a trend that began back in October 2025. In recent years, the software sector within the S&P 500 has traded at higher valuations than the broader market, representing a valuation premium. This premium reflects the additional amount investors are willing to pay for companies perceived to have stronger growth prospects, as indicated by their price-to-earnings (P/E) multiples. However, this valuation premium has recently reduced to just three times the market value post a peak of 22 times back in 2021.

S&P 500 Software sector valuation premium versus the S&P 500

Source : Artorius, Bloomberg.

What happened in October 2025 that changed the game?

October 2025 is said to have been a pivotal month for AI software engineering, marked by a significant shift from AI assistants to agentic tools. Agentic tools are AI systems that don't just provide information, they can proactively execute multi-step tasks to achieve a specific goal.

For example, a standard AI assistant would be able to carry out a flight search to a specific destination with a price cap and then provide options with links for the user. The user would then need to finalise the booking by putting in their information and payment method. They would also need to add it to their calendar separately too. The agentic tool, on the other hand, would be able to go multiple steps further, finding the flight, booking the flight, sending the receipt to the accounting department and adding it to the user’s calendar with a reminder to check-in 24 hours before departure. Simply put, it moves AI from a "chat" interface to an "action" interface.

Will SaaS companies respond to the competitive threat from AI?

The speed of development in the tools that AI companies can offer is likely to have caught many SaaS companies by surprise. However, we would expect them to respond to ensure they have a competitive offer for their customers. In reality they will already have been doing so but recent developments will now accelerate the pace of change. What this looks like and how effective it might be is very uncertain at this stage.

Many companies have already integrated AI capabilities directly on to their platforms (e.g. Copilot with Microsoft) to enhance their capabilities. However, given the rapid pace of AI development, it remains unclear how organisations will continue to evolve their AI strategies, particularly as competitive pressures intensify for those that choose not to adopt these technologies. Some companies will partner with AI businesses like Anthropic, others might look to acquire an AI start-up business and others may choose to invest internally in AI.

Going forward, SaaS companies might be considering re-positioning themselves as platforms that AI agentic software plugs into. However, if the SaaS company doesn’t own the AI themselves, they risk losing profits to the AI companies. An exception to this could be for sectors where the software provider is being used for high-stakes tasks that require 100% accuracy. Examples of this would be in areas like tax and payroll where AI’s current tendency to make mistakes is still too risky.

Is the main threat to human labour?

Market sentiment is certainly negative on the future prospects for SaaS companies at present due to the perceived threat of AI taking its place and/or its profits. However, another perspective might be that if SaaS companies are sufficiently agile and they integrate AI technology appropriately, then actually, it might be human jobs that become most at threat in the longer term.

Winners and losers guaranteed

AI technology continues to advance and provides both opportunities and threats for both companies and consumers alike. Whether its usage provides a productivity boost or it will be a substitute for existing software technology remains to be seen. The answer is not going to be simple. In the case of the impact on SaaS, the commercial environment is very complex and layered with different ways of working in multiple sectors. This means the pace of change is unlikely to be uniform and how it impacts each company will vary. How each SaaS company responds from here is also unknown.

We can see why the development of workflow automation in certain sectors could be a threat to some SaaS businesses. However, we also see many SaaS companies that have deep existing client relationships, strong brands and significant sector expertise. This also sits alongside existing product distribution. Therefore, substitution by end user from an existing SaaS product provider to a new AI company product seems too simple. Our expectation at this point is for there to be a evolution of existing SaaS business models, products and pricing. Who retains the profit within future client contracts will be key and depends on new product development, but an entire SaaSpocalypse seems unlikely, at least at the moment.

Phil Carroll

Head of Alternatives

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 13th February 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20260213001