The 'Central Casting': Kevin Warsh Tapped to Lead the Federal Reserve

The 'Central Casting': Kevin Warsh tapped to lead the Federal Reserve

Following months of speculation, in a move that combines Wall Street experience with an expected sharp pivot in monetary philosophy, President Donald Trump announced on 30 January 2026, that he has nominated Kevin Warsh to succeed Jerome Powell as the next Chair of the Federal Reserve.

Warsh, 55, is a familiar face in the marble corridors of the Federal Reserve. Having served as the youngest ever Governor from 2006 to 2011, he earned a reputation as a pragmatist during the 2008 financial crisis. However, his return marks a significant moment for global markets, as he represents a distinctive "hawk-turned-unknown (but assumed dove)" profile that many expect to align closely with the Trump administration's wish for a low-interest rate agenda, but the reality could be that this is wide of the mark.

A Financial Pedigree

Warsh’s CV reads like a blueprint for the modern financial elite. A graduate of Stanford and Harvard Law, he spent seven years at Morgan Stanley before joining the George W. Bush administration as a top economic adviser.

During his previous tenure at the Fed, Warsh was often viewed as a "monetary hawk," frequently criticising the scale of quantitative easing (QE). His resignation in 2011 was widely interpreted as a protest against the second round of bond-buying (QE2), which he feared would blur the lines between monetary and fiscal policy.

"Institutional drift has coincided with the Fed's failure to satisfy an essential part of its statutory remit, price stability," Warsh remarked in a recent speech, echoing his long-standing concerns about "mission creep”, referring to the gradual expansion of the central bank's focus and activities beyond its original, legally defined mandate, at the central bank.

The Policy Pivot: Lower Rates, Smaller Balance Sheet

While Warsh's historical leanings were hawkish, his recent rhetoric has struck a chord with the Trump administration’s desire for more aggressive interest rate cuts. This stance, coupled with his belief that the Federal Reserve's balance sheet—which expanded significantly during his previous stint as a governor—poses a greater risk to long-term stability than low interest rates, suggests a potential pivot from current Fed policy.

Warsh argues that the Fed has become too “backward looking”, and that new technologies—especially Artificial Intelligence—will naturally help keep inflation from rising too quickly. If technology keeps inflation low on its own, he believes the Fed can safely cut interest rates without causing prices to surge again.

Market Reaction

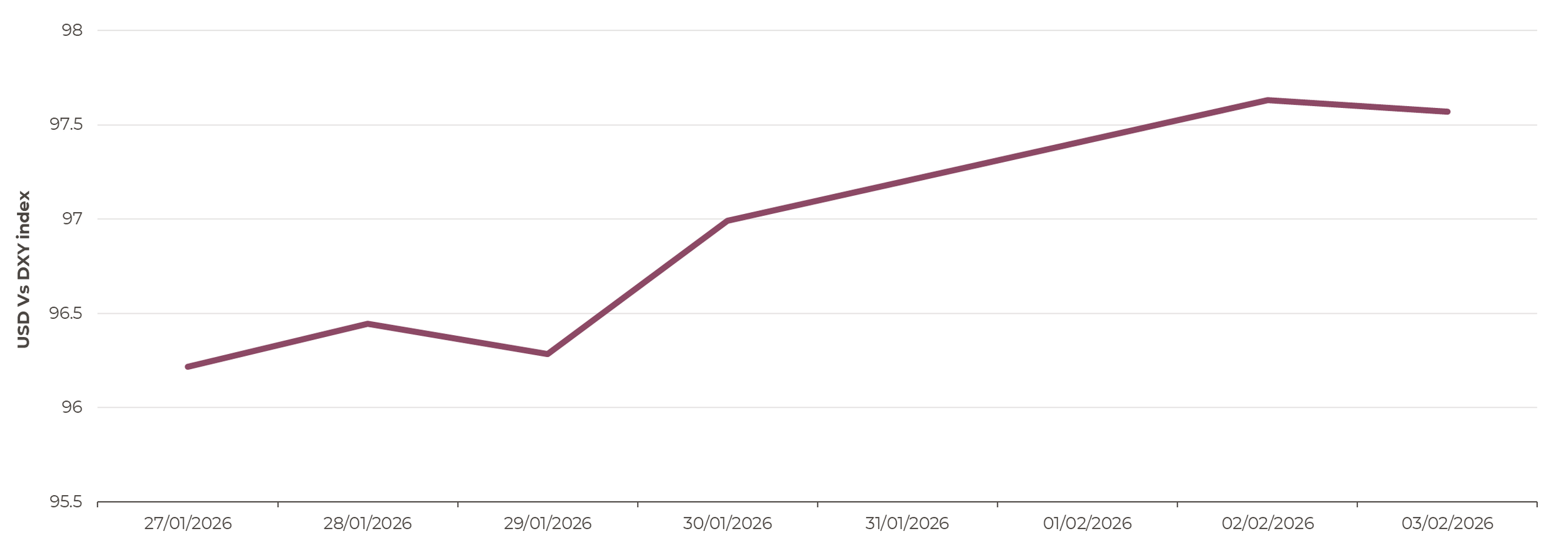

The news of Warsh’s nomination sent immediate ripples through global markets. Following the announcement, the US Dollar Index (DXY)—which tracks the Dollar against a basket of six major currencies—rebounded by over 1% (see chart below), marking a sharp reversal after hitting a four-year low earlier in the month. The dollar gained significant ground against the Euro (EUR/USD) and the Yen (USD/JPY), as investors found renewed confidence in the Federal Reserve's future autonomy and Warsh’s reputation as a "rational" institutionalist.

The dollar rebounded against other major currencies following the news of the appointment

Source : Artorius, Bloomberg.

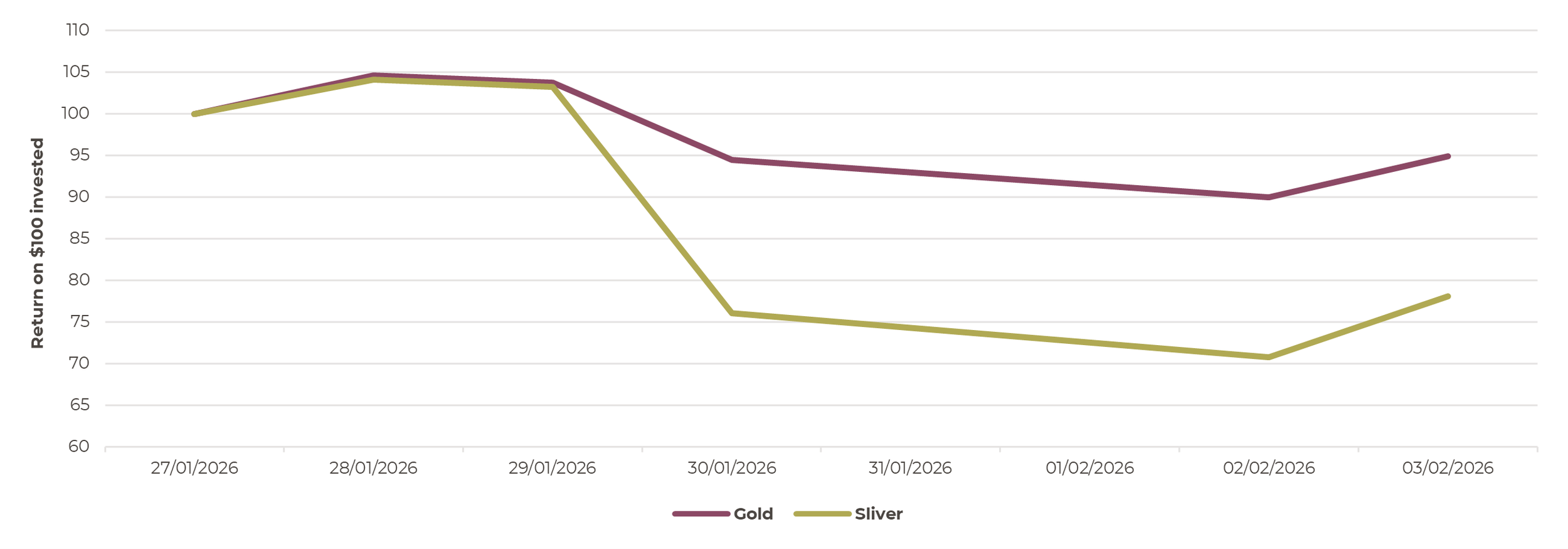

Precious metals experienced a dramatic "meltdown" as the nomination upended the flow of money out of US dollars and into precious metals, reversing the record‑breaking rally that had been fuelled by policy uncertainty. On 30 January, gold plummeted by over 10%, briefly dipping below the $5,000 mark after hitting an all-time high of nearly $5,600 just hours earlier. Silver suffered an even more violent reversal, crashing by 35%, its largest single-day percentage decline on record. Analysts attributed the sell-off to profit-taking by investors who had bet on an "ultra-dove" appointment reducing positions due to increased confidence in the dollar following Warsh’s appointment.

Gold and silver reacted negatively to the news of the appointment

Source : Artorius, Bloomberg.

In the UK, the Bank of England (BoE) faces a diverging path. While Warsh may lead the Fed toward a more dovish rate environment in the long term, the BoE remains grappled with sluggish growth and stubborn inflation. If the Fed cuts rates more aggressively than the BoE, we could see a period of sterling strength.

The Confirmation Battle Ahead

Despite the "wide acclaim" from industry figures Warsh faces a rigorous Senate confirmation process. Critics, led by Democratic Senator Elizabeth Warren, have already raised concerns about his ties to Wall Street and his potential to compromise the Fed’s political independence.

Furthermore, some Republican senators have suggested they may delay the process until ongoing investigations into the Federal Reserve’s headquarters renovations and internal conduct are resolved. If the confirmation extends past May, Vice Chair Philip Jefferson is expected to serve as acting chair.

While Warsh's actual leadership style remains to be seen, his apparent alignment with the Trump administration’s agenda raises questions about whether his stance is genuine or strategic. Regardless, his nomination marks a potential shift in the Fed's direction, though perhaps not as extreme a pivot as many previously believed was on the cards.

Josh Young de Ferrer

Portfolio Manager

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 6th February 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20260206001