Red Hot Metals

Red Hot Metals

Markets have moved fast in January and the news-cycle has been, at times, overwhelming with Venezuela, Greenland, Minneapolis and even Gorton and Denton (in the UK at least) leading the news. For investors, the hottest part of the market has been metals, with gold and silver leading the way albeit with increasing volatility. Today, however we’re going to look at another metal that has been on a tear, copper.

Number 29

Copper is a chemical element with the symbol Cu and atomic number 29 on the periodic table, derived from the Latin cuprum. It occurs naturally in metallic form and has been used by humans for thousands of years. It is a soft, malleable, ductile metal known for its distinctive reddish-orange colour and exceptional electrical and thermal conductivity. This makes it indispensable in a wide range of industrial and consumer applications, and its role in the electrification and decarbonisation of the global economy is foundational. Its excellent conductivity, corrosion resistance, and versatility make it the preferred material for electrical wiring, motors, transformers, and power infrastructure. The shift to electric vehicles (EVs) has dramatically increased copper demand—EVs use roughly 2–4 times more copper than internal combustion engine vehicles—and renewable energy systems such as wind and solar and grid upgrades require substantial copper inputs for cables, substations and transmission lines. More recently, the accelerating build-out of data centres and AI infrastructure is a rising source of demand as these facilities demand large quantities of copper for power distribution and connectivity. These trends collectively underpin projections of significant long-term growth in copper consumption as electrification accelerates across sectors.

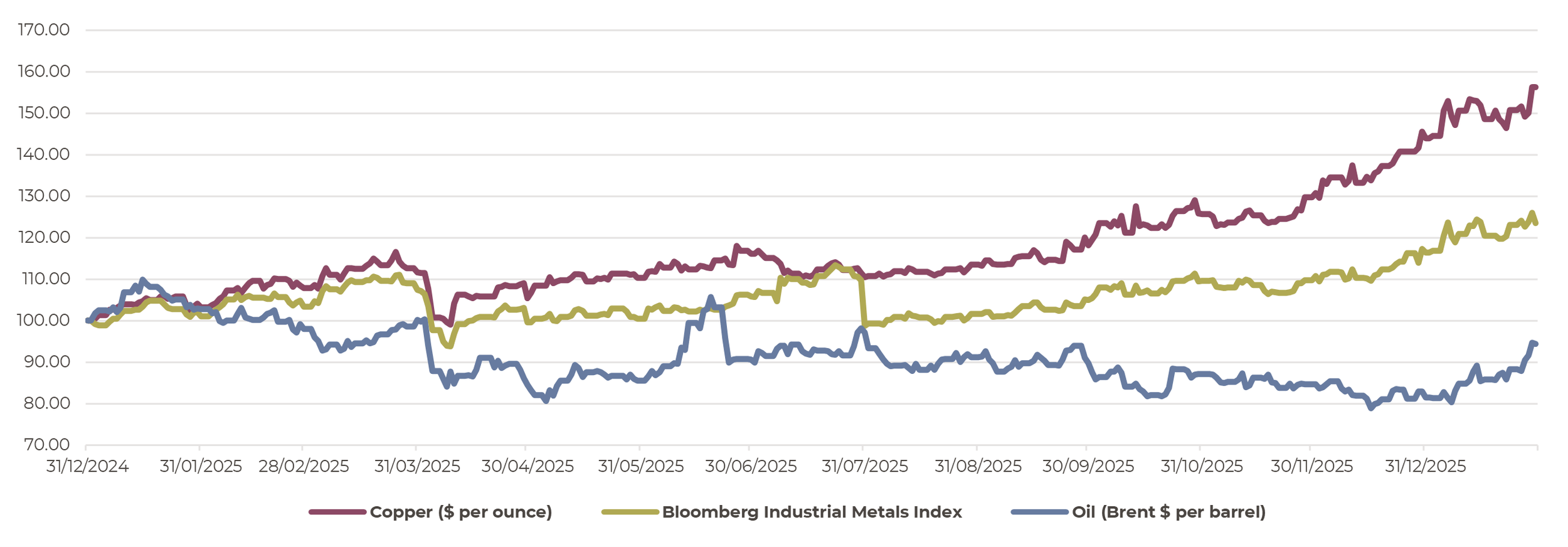

Since “Liberation day” copper has outpaced other cyclical commodities

Source : Artorius, Bloomberg. Data is normalised starting with 100 as at 31 December 2024.

Copper has rallied strongly since Liberation Day, surging over 50% in eight months. In normal times, copper serves as a barometer of economic health, as it is highly sensitive to industrial activity, and so tends to perform well during periods of economic expansion. Hence, such a rapid rise in price would suggest a stronger global growth outlook. However, these are not normal times. While other industrial metals have performed well, other cyclical commodities, such as oil, have been weak, while gold, typically a “fear” asset, has been setting new record highs. In a world driven by geopolitical noise and the insatiable demand for AI, perhaps markets are becoming untethered from traditional signals, or it may be idiosyncratic.

Years of chronic underinvestment have left global copper mine capacity stretched to its limits and there have been a number of notable supply disruptions over the last year across Chile, Congo and Indonesia, leaving little slack to absorb surging demand. Bringing on supply is rarely quick as mines typically have long lead times, which limits the ability to increase production. Copper miners seem more focused on M&A activity than expanding production, with significant consolidation in the industry, most notably an agreed merger between Anglo-American and Teck Resources to create a new global copper mining giant. With continued demand from electrification and AI capital expenditure likely to keep growing, further price gains are likely, unless the macro outlook deteriorates.

Au>Cu

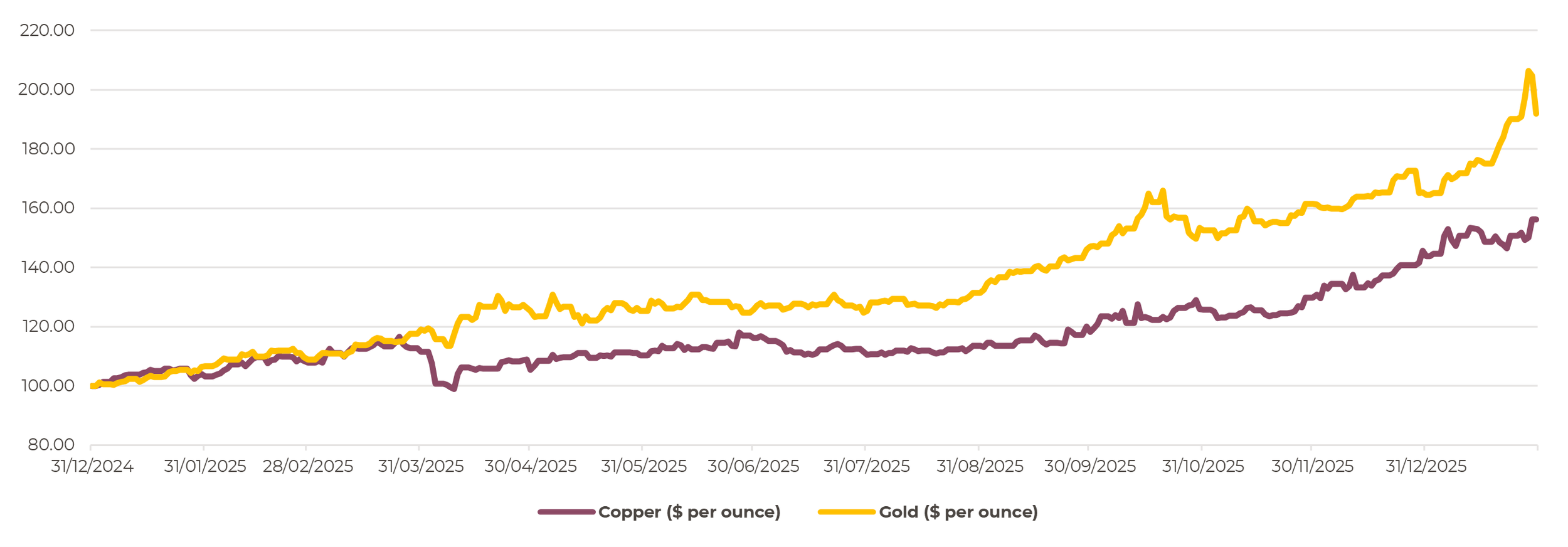

The move in gold prices has vastly outstripped the gains in copper

Source : Artorius, Bloomberg. Data is normalised starting with 100 as at 31 December 2024.

While copper’s price rise has outstripped other industrial metals and oil, it has been vastly outstripped by the performance of gold and other precious metals. Historically, the relationship between gold and copper has been used as a useful barometer of the economic cycle, reflecting the tension between growth optimism and defensive positioning. Copper is highly sensitive to industrial activity, while gold, by contrast, is primarily a store of value, typically favoured during times of uncertainty or financial stress. When copper outperforms gold, it usually signals confidence in global growth and rising cyclical momentum; conversely, gold outperforming copper has often preceded or coincided with economic slowdowns or recessions. The current relationship is somewhat confusing. While copper benefits from both cyclical growth and the huge build-out of AI-related data centres (a trend confirmed by recent corporate earnings), gold is reflecting both macro uncertainty and a structural shift away from the US dollar by emerging markets central banks. Therefore, the relationship, which at a glance would suggest extreme fear, may no longer be a useful guide for investors.

We need to talk about Kevin

President Trump has said he will nominate Kevin Warsh as the next Federal Reserve chair. Warsh, a former Fed governor, will succeed Jerome Powell when his term as Fed chair ends in May, subject to Senate approval. While one would normally expect that to be a formality, with a highly qualified candidate and the Republicans controlling Congress, there are complications. Some Republican senators, led by North Carolina’s Thom Tillis, have said they will refuse to advance Trump’s pick until the Department of Justice drops its investigation into Jerome Powell. It remains to be seen whether this resistance can be maintained.

On Wednesday, the Federal Reserve, led by current Fed chairman Jerome Powell, as expected, held interest rates steady at 3.75%, once again defying President Trump’s desire for lower interest rates. The two dissenters in a 10-2 vote were recent Trump appointee Stephen Miran and longstanding Fed governor Chris Waller. Waller has long been one of the more dovish governors and, at time of voting, was perceived to still be a contender for the position of next Fed Chairman.

Market consensus is that the Fed will make cut interest rates twice in 2026 but will be under pressure to cut further. However, with inflation still above target, US economic growth looking strong, and signs of stabilisation in the labour market, it isn’t clear that further cuts are required. How the appointment of Kevin Warsh to lead the Fed will affect decision-making is unclear. We can only assume that he is being appointed because he is expected to be dovish and drive interest rates down, but even as chair he is only one vote and may not necessarily bring the whole committee with him. An interesting side-plot is that while Jerome Powell will no longer be Fed Chairman, he will stay as a governor for two years and could still remain influential, in which case expect further insults to head his way from the President.

Historical data shows that when the Fed is cutting interest rates and the economy is not in recession, equities have performed strongly. That is the current market consensus. However, were the path of interest rates to change - particularly if driven by higher inflation resulting from strengthening growth - the consensus could be challenged, and high valuations might come more sharply into focus for investors.

Gareth Thomas, CFA

Head of Investment Management

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 30th January 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP2026013001