Mind the short-term turbulence

Mind the short-term turbulence

Summary

As long as profits continue to climb and the Federal Reserve continues to cut interest rates, equities are supported.

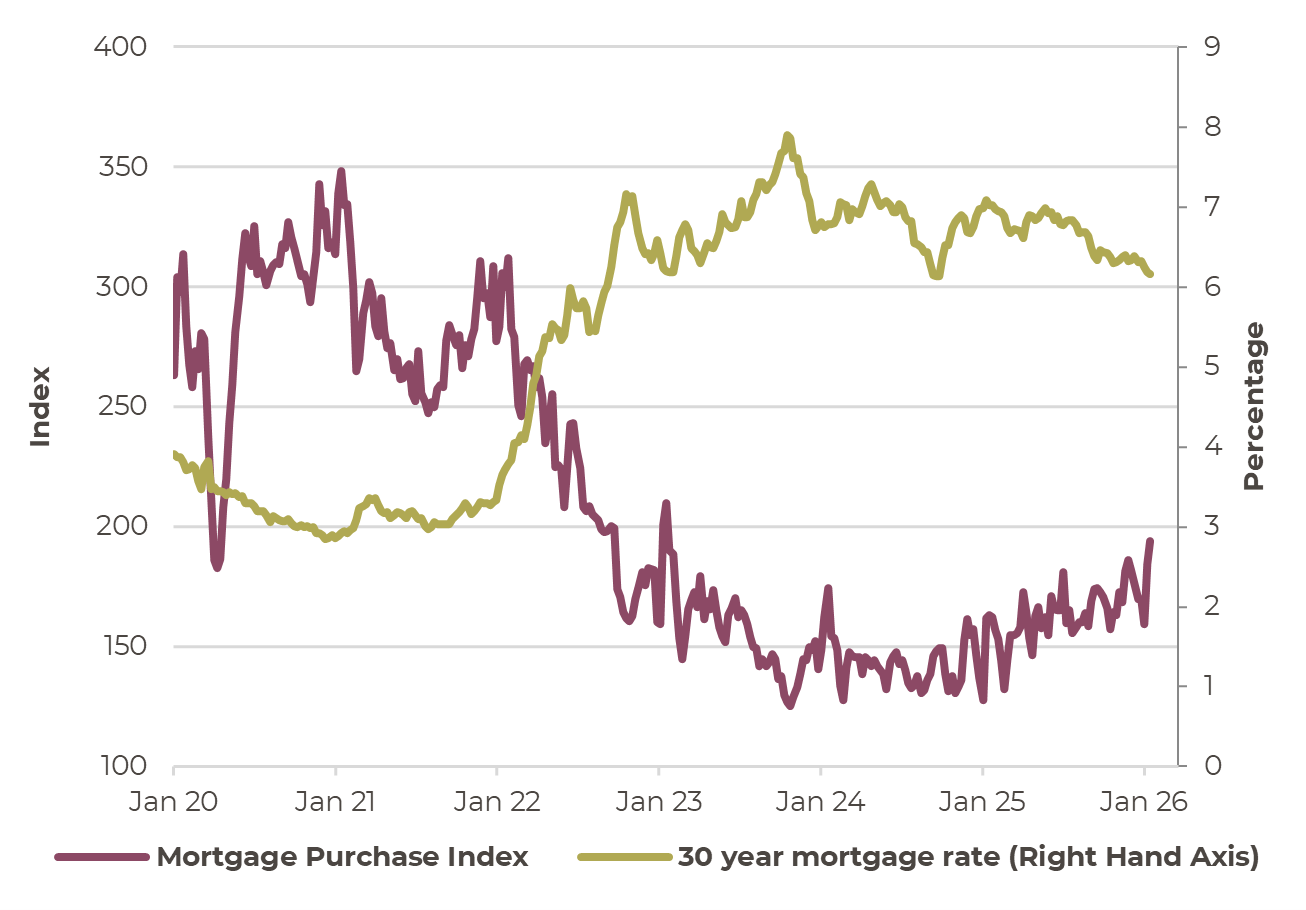

Interest rate cuts, monetary policy nudges by the White House and fiscal stimulus are likely to drive stronger economic growth in the US. There are signs of a recovery in the US housing market as lower mortgage rates feed through to a recovery in borrowing. This has been one sector that has been in a recessionary type environment for a few years, so a return to higher levels of housing transactions would be a net positive for the rate of economic growth.

This positive backdrop is set against an equity market where valuations are challenging, especially in large US equities. The combination of improving economy and more attractive valuations has resulted in a long-awaited recovery in US cyclicals and non-US equities relative to US equities, in terms of performance over the past few months. The nature of recovery is risk-on but also suggests an early cycle dynamic. This may strike readers as odd given that equity markets are close to all-time highs.

The outlook is skewed by the US actions in Venezuela, threats to Greenland and events in Iran, but fundamentals remain upbeat for investors who are willing to tolerate the episodic nature of President Trump’s tantrums.

Hidden Quantitative Easing?

Amidst the sound and fury of Trump’s actions and pronouncements around Venezuela, Iran and Greenland, there was an announcement pertaining to the US mortgage market that could aid the US housing market recovery and the wider US economy. On Thursday 8th January, President Trump instructed Fannie Mae and Freddie Mac, government-sponsored enterprises, to buy $200 billion of mortgage bonds, which should reduce the effective borrowing costs for mortgages.

Fannie Mae and Freddie Mac, who were bailed out by the US government during the 2008 financial crisis, have already been increasing their holdings of mortgage bonds. There are roughly $9 trillion worth of agency mortgage bonds outstanding, so if Fannie and Freddie carry out all the purchases it would amount to just over 2% of the market. This may not sound like a lot, but the announcement triggered a reduction in mortgage rates. The evidence shows that there has been a steady pickup in mortgages in the US economy. This is shown in the chart to the right by the continued rise in the Mortgage Purchase Index, which is a measure of the number of mortgages created to enable home purchases. Whilst still way off the levels seen in 2021-22, the slight decline in mortgage rates seen through 2024-25 is helping a recovery in activity in the US housing market.

President Trump’s domestic agenda seems focussed on quickening the pace of economic growth, and this is one small nudge in that direction.

US mortgage activity is turning up in response to lower bond yields

Source: Bloomberg, Artorius

Judgement Day delayed

The US Supreme Court is due to rule on the legality of President Trump’s tariffs levied in 2025. It had been thought that the ruling would be issued in January 2026 after the hearing on November 5th, 2025. But with a recess due, the ruling will be delayed until February 2026.

Research from the respected Kiel Institute found that the burden of the tariffs almost entirely fell on the US economy rather than overseas exporters. The research team analysed more than 25 million shipment records covering a total value of almost four trillion US dollars in US imports. The findings are clear:

US customs revenue increased by approximately $200 billion US dollars in 2025, which is handy given the scale of the US government deficit. But the cost of the tariffs is being borne unevenly.

Foreign exporters absorbed only about four percent of the tariff burden, 96 percent passed through to US buyers.

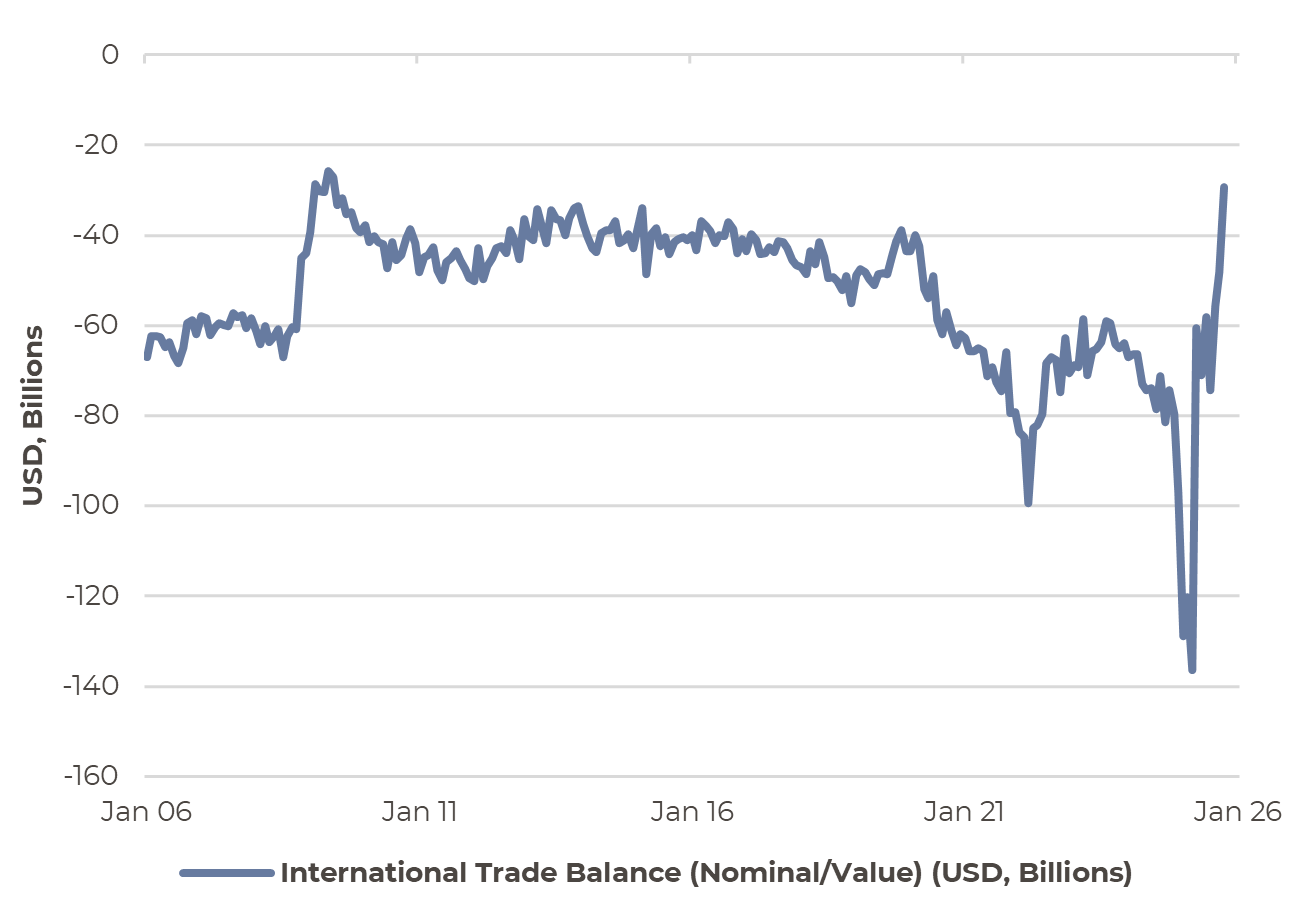

One impact of the tariffs is the reduction in the US trade deficit. Some of this narrowing represents a reversal of the excessive trade deficit seen at the end of 2024 and at the start of 2025, but it represents a shift in global trade patterns.

US Trade Balance has shrunk from a huge deficit at the end 2024

Source: Bloomberg, Artorius

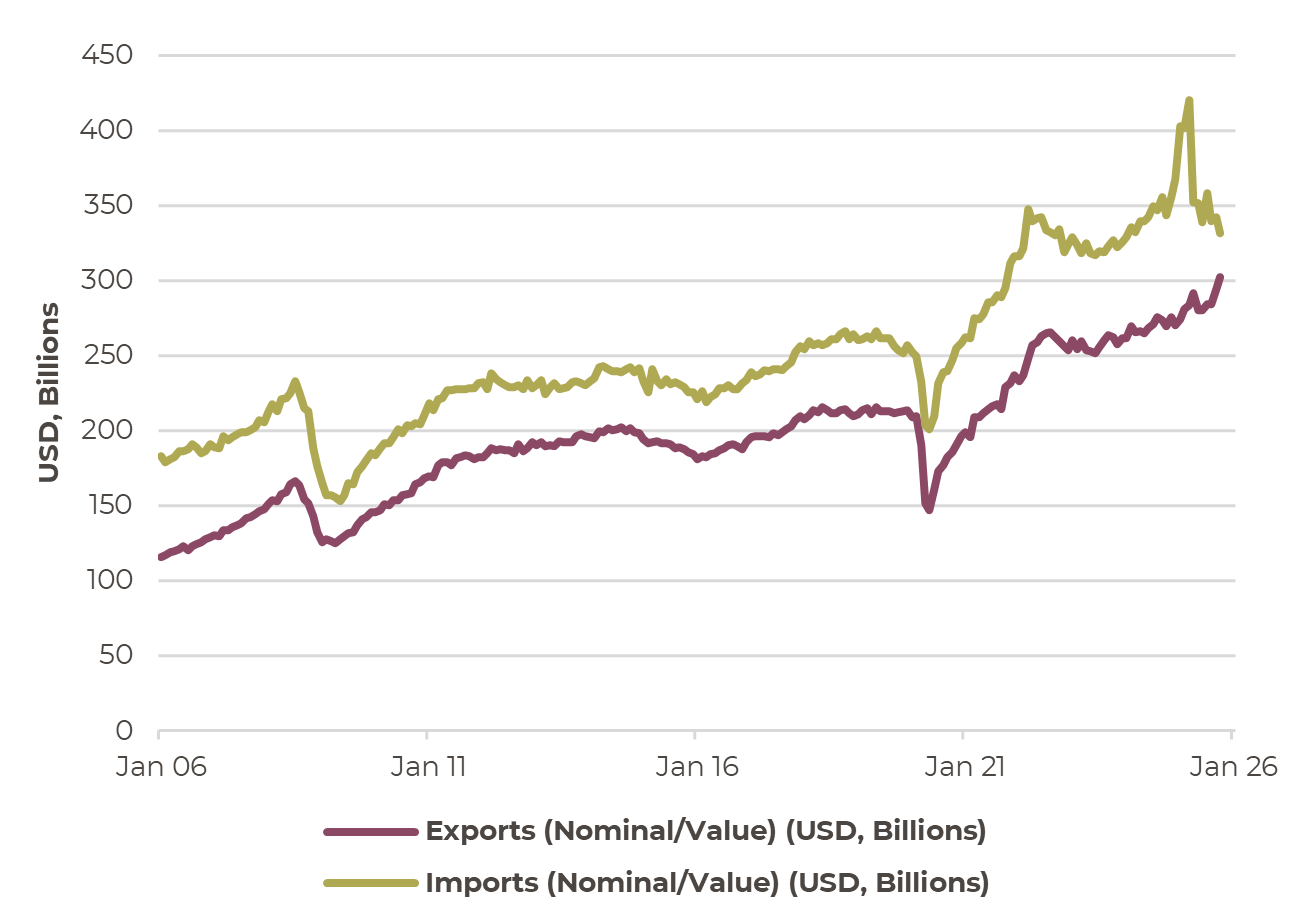

The pattern of imports shown in the chart on the right, reflects the pre-tariff import surge at the end of 2024 and the start of 2025, but since the summer of 2025, import levels have fallen back.

Readers may think it interesting that export levels continued to rise, despite apparent overseas antagonism towards some U.S. policies.

This reduction in the trade balance is a net positive for the US economy in terms of how Gross Domestic Product (GDP) is mathematically calculated. But in reality, import volumes are down which indicates that the US economy continued to enjoy only modest growth in 2025.

US import and export levels show that the import volatility is stark in comparison with continued export growth

Source: Bloomberg, Artorius

The great turning

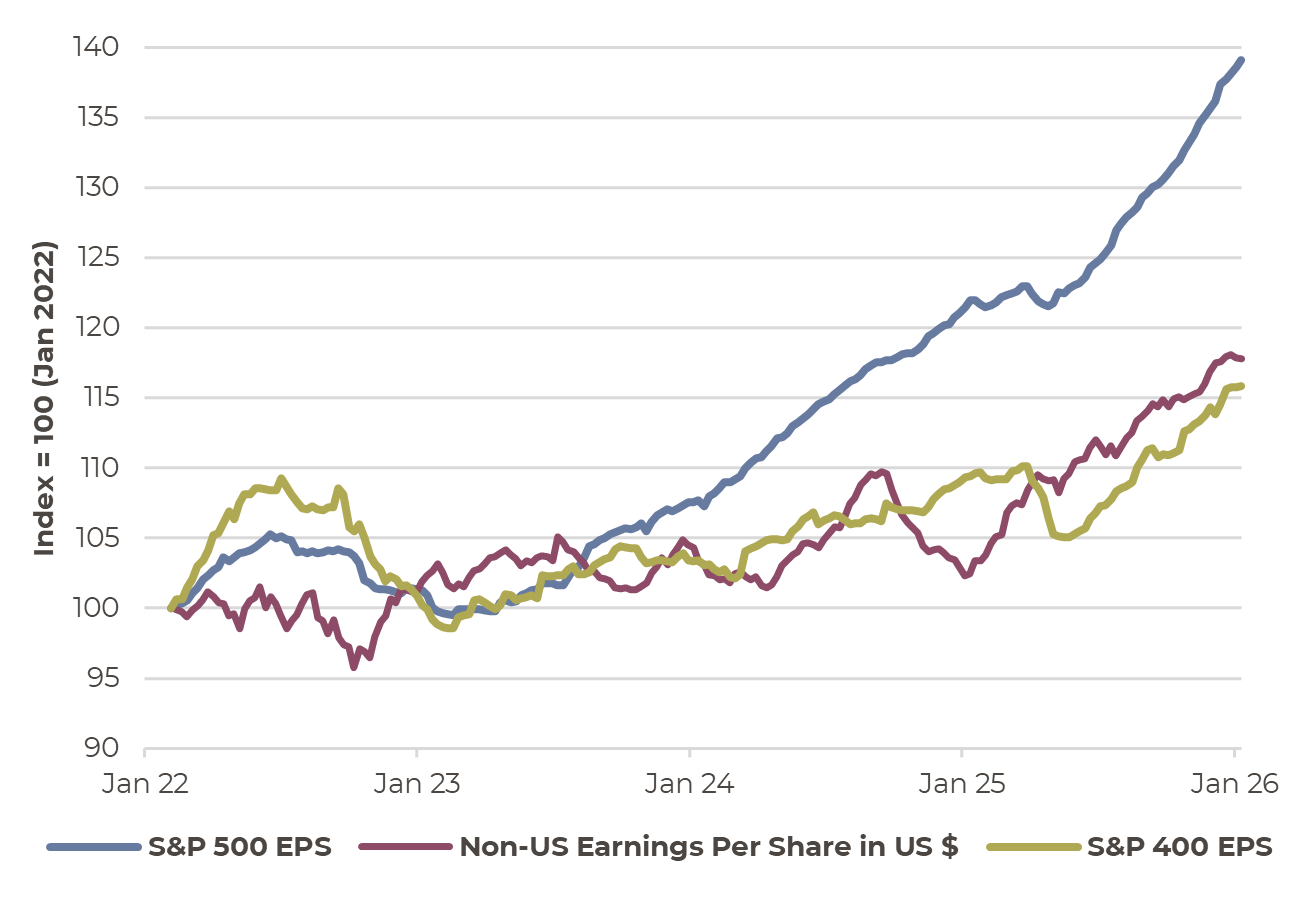

For a few years the only investment decision to make was to allocate to US equities and US technology in particular. In recent months that thesis has been challenged with non-US equities starting to outperform US equities. Even more intriguingly the nature of performance within the US equity market is evolving. Until recently, US equity performance had been dominated by the large US technology companies. After all, they had effectively been the only sector delivering robust earnings growth.

This started to change in 2025. Firstly, the shock of the Chinese DeepSeek AI model challenged the hegemony of US AI leadership. Secondly, the improvement in the state of economies in Europe and Emerging Markets meant that earnings in these regions started to improve (at least in US Dollar terms).

The backdrop of a recovery in earnings in non-US equities and in US Small and Mid-sized companies has seen these sections of the global equity market outperform US equities in recent months. Is this the long-awaited rotation away from US technology?

The most striking performance pattern is that the new ‘leaders’ in the equity market are those sectors that typically do well in the recovery post a recession. Whilst the US economy has been sluggish in recent years, there have been recessionary conditions in manufacturing and the US housing market as well as subpar economic conditions in Europe. So, whilst equities are close to all-time highs, investors may have the sunlit uplands of a post recessionary recovery to look forward to in 2026.

The major risk in our view, to such an optimistic view, aside from geopolitical shenanigans from President Trump, is one where a better-than-expected economic backdrop results in higher-than-expected inflation. Higher inflation (which is a low possibility at the moment) may then force the hand of Central Banks to stop cutting interest rates. But in the meantime, if economies continue to be resilient and earnings growth robust, investors may enjoy another period of solid returns in risk assets.

US mid-cap and non-US earnings per share (EPS) are picking up, supporting an improvement in performance

Source: Bloomberg, Artorius

Greenland and Tariffs

The latest escalation in geopolitical tensions could create market volatility in the short term. However, as seen with other geopolitical events including the US strike against Iranian nuclear facilities and the arrest of Venezuela’s president Maduro, wider financial markets tend to respond less to quick conclusive actions.

A prolonged standoff or a retaliatory tariff escalation between the US and the EU (in its defence of Denmark / Greenland), with both sides exerting economic and political pressure on one another, would, in our view have the most damaging effect on risk assets.

That said, pointing to military options may be part of a US negotiation strategy to extract concessions. Experience from last year shows that the Trump administration is prepared to negotiate and dial back tariffs from initially imposed levels.

The impending Supreme Court judgment on the use of IEEPA (International Emergency Powers Act) tariffs, were it to deem them unlawful, could also hamper President Trump’s ability to impose fresh tariffs.

We suggest that the trade war has become an episodic headwind. Tariffs come back into the headlines when markets least expect it and then they slowly fizzle away, normally with President Trump walking back from imposing heightened levels of tariffs, when other countries stand-up to the ‘bullying’ behaviour.

The most recent episode was observed on October 10th, when President Trump threatened a 100% tariff on China, beginning November 1st, just 21 days out from the announcement. This timing may sound familiar, and that's because it's an integral part of the playbook. Immediately after, S&P 500 futures extended losses to -3.5% on the day before closing for the weekend.

President Trump seems to lead with a punishing and threatening message; it's part of his negotiation tactic. In the October bout with China, it ended with a new trade deal and China removing rare earth export restrictions, which Trump said were harming the US. But ultimately tariffs levied on China haven’t derailed the Chinese economy.

We are mindful of potential short-term volatility but suggest that if fundamentals remain supportive in terms of robust economic growth and supportive fiscal and monetary policy, then markets should weather the Atlantic storm.

Conclusion

As long as profits continue to climb and the Federal Reserve continues to cut interest rates, equities are supported.

Interest rate cuts, monetary policy nudges by the White House and fiscal stimulus are likely to drive stronger economic growth in the US. There are signs of a recovery in the US housing market as lower mortgage rates feed through to a recovery in borrowing. This has been one sector that has been in a recessionary type environment for a few years, so a return to higher levels of housing transactions would be a net positive for the rate of economic growth.

This positive backdrop is set against an equity market where valuations are challenging, especially in large US equities. The combination of improving economy and more attractive valuations has resulted in a long-awaited recovery in US cyclicals and non-US equities relative to US equities, in terms of performance over the past few months. The nature of recovery is risk-on but also suggests an early cycle dynamic. This may strike readers as odd given that equity markets are close to all-time highs.

The outlook is skewed by the US actions in Venezuela, threats to Greenland and events in Iran, but fundamentals remain upbeat for investors who are willing to tolerate the episodic nature of President Trump’s tantrums.

*Any feedback provided can be anonymous

Important Information

Artorius provides this document in good faith and for information purposes only. All expressions of opinion reflect the judgment of Artorius at 23rd January 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results.

Nothing in this document is intended to be, or should be construed as, regulated advice. Reliance should not be placed on the information contained within this document when taking individual investment or strategic decisions.

Any advisory services we provide will be subject to a formal Engagement Letter signed by both parties. Any Investment Management services we provide will be subject to a formal Investment Management Agreement, which will include an agreed mandate.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20260123001