Year in review

Year in review

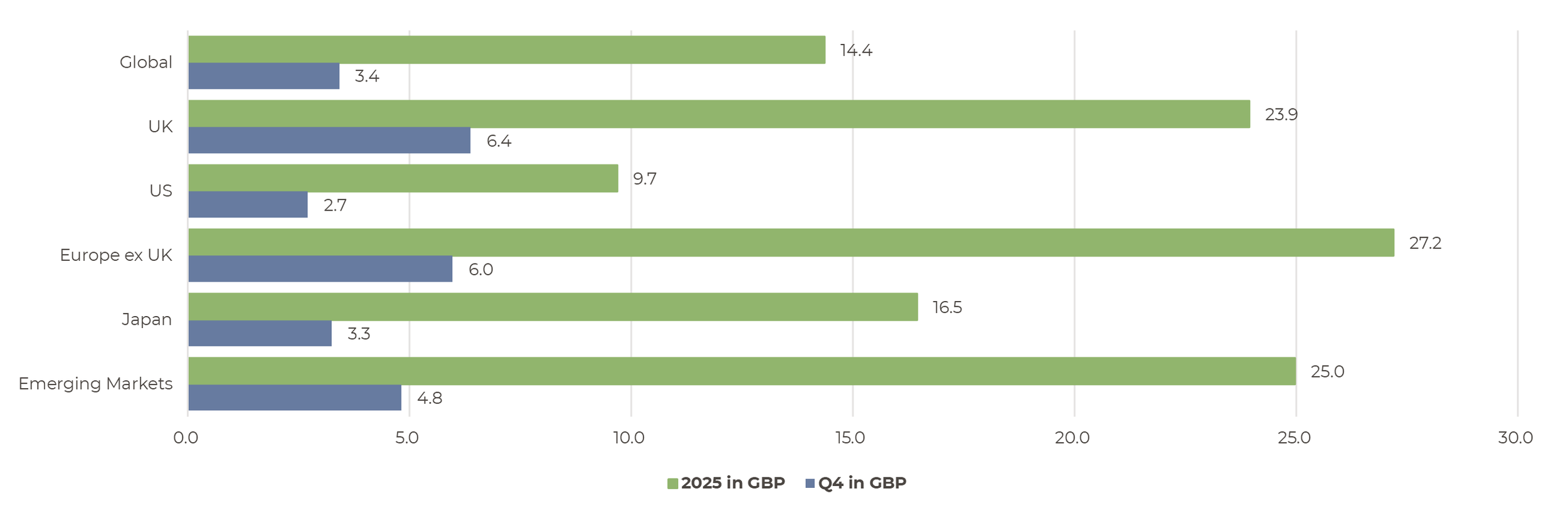

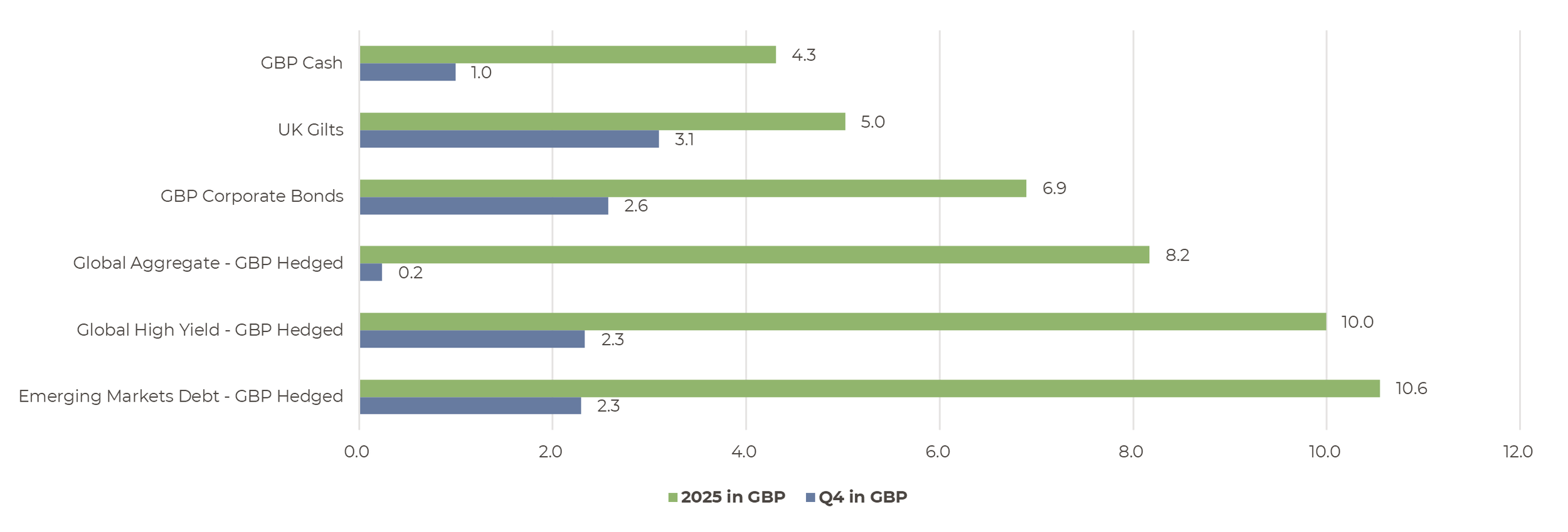

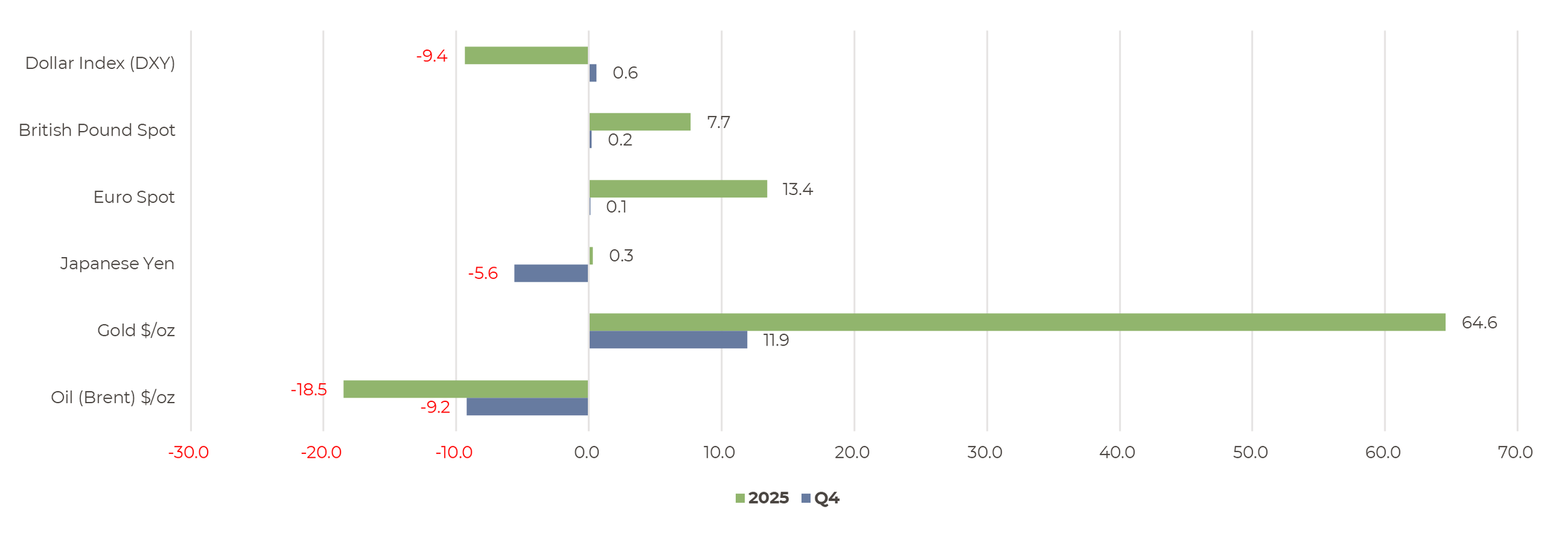

2025 concluded with a strong quarter with broad based gains across asset classes and regions to finish the year on a high. Global equities ended the year close to record highs and delivered over 14% for a Sterling investor. The US gave up its market leadership with European markets (notably Spain and Italy) and Emerging Markets (notably Korea) leading the way. Despite the lingering threat of inflation, fixed income markets also delivered good returns as central banks delivered interest rate cuts leading to an 8% return for global bonds. In Alternatives, Gold (and other precious metals) delivered exceptional returns up nearly 65% in 2025, while other commodities (notably Oil) lagged. Hedge Funds in aggregate delivered solid single-digit returns, while Private Markets (in its listed form at least) struggled amidst concerns over Private Credit.

Strong returns across all equity regions but the US lagged on the back of US dollar weakness*

Source: Bloomberg, Artorius

Indices used are: Global – MSCI All-Country World, UK – MSCI UK, US – S&P 500, Europe ex UK – MSCI Europe ex UK, Japan – MSCI Japan, Emerging Markets – MSCI Emerging Markets

Artificial Intelligence (AI) remained the dominant theme driving equity markets. AI-related stocks, notably semiconductor stocks, outperformed the broader market. However, as investors try and discern the eventual winners and losers in the AI race, only two of the so-called “Magnificent Seven” tech companies (Alphabet and Nvidia) outperformed the S&P 500. Consumer-facing sectors struggled as sluggish job growth weighed on consumer confidence. Concerns about softening demand meant that companies were nervous about passing on tariff costs. This helped avoid an inflation spike but dampened returns from these sectors.

European equities performed strongly led by Financials, particularly Banks. At a country level Spain and Italy led the way with their Banks to the fore. Europe also benefited from the AI trade, primarily through semiconductor companies like ASML) but is relatively underexposed.

The UK followed a similar pattern to the rest of Europe wit Banks performing very strongly. The other major winning sector was Aerospace & Defence with BAE Systems and Rolls Royce performing strongly, as European rearmament was a major driver.

Emerging market equity performance was broad based with all regions posting strong returns. AI enthusiasm was supportive as investors focused on the crucial role the region plays in the technology supply chain. The largest company in Emerging Markets is TSMC, (Taiwan Semiconductor) which is at the heart of semiconductor supply chain and rose over 40%. Korea was the strongest market with a combination of AI excitement, corporate governance reforms and a low entry point after a difficult 2024 leading to significant gains. The largest market, China, also performed well, returning 22% over the year, despite tariff turmoil as homegrown AI boosted the tech sector, and Chinese exports found new homes despite US tariffs.

In Japan, hopes for continued reflation were boosted by the election of Prime Minister Takaichi, with markets factoring in the likelihood of greater government spending. In local currency terms the TOPIX returned 25.5%.

Strong returns across all equity regions but the US lagged on the back of US dollar weakness

Source: Artorius, Bloomberg

Indices used are: GBP Cash – Barclays Benchmark Overnight GBP Cash Index, UK Gilts – Bloomberg UK Government All Bonds, GBP Corporates – IBOXX Sterling Non-Gilts, Global Bonds – Bloomberg Global Aggregate Hedged GBP, Global High Yield – Bloomberg Global High Yield Hedged GBP, Emerging Markets Debt – Bloomberg EM Hard Currency Aggregate Hedged GBP

Despite lingering inflation and concerns over debt sustainability in a number of economies, bond markets were generally positive over the year as central banks cut interest rates and bond yields fell across the curve. The rally in risk assets extended to fixed income, where spreads compressed across the board. Emerging market debt was the top-performing fixed income sector up 10.6% in 2025 driven by a combination of strong economic fundamentals and investor demand. High Yield bonds were also very strong up 10% driven by high starting yields and ongoing spread compression. Default rates are edging up but, despite some well-publicised defaults in private credit and leveraged loans, corporate balance sheets generally remain robust.

Dollar weakness is over (at least for now) while Gold outshines everything else

Source: Artorius, Bloomberg

The Dollar Index compares the US Dollar to a basket of currencies. British Pound, Euro Yen, Gold and Oil are shown as performance versus the US Dollar. A spot rate is the current price at which an asset, like a currency or commodity, can be bought or sold for immediate delivery.

US dollar weakness was the story of the first half of the year, which had a significant impact on returns, but seems to have stabilised for now versus other major currencies. The Euro has been exceptionally strong as Germany took its foot off the fiscal brake after 15 years of consolidation and the region looks to meaningfully increase military spending in the face of Russian aggression and US pressure.

Gold has been one of the top performing assets in 2025 and continued to perform strongly in the 4th quarter. A combination of expected interest rate cuts, continued concerns over major government debt/deficit levels, and persistent geopolitical uncertainties, has driven significant investor demand, which shows no sign of abating.

Conclusion

2025 was a positive year for investors but also serves as a reminder of the importance of diversification and currency exposure. After a decade of US exceptionalism with returns concentrated in US technology stocks, 2025 saw a broadening of growth to the rest of the world with the US lagging and the US dollar falling sharply. The strongest performance came from sometimes forgotten markets, Spain and Italy (particularly Banks) surged, Korea (semiconductors leading the way) and from regions that were in the eye of the tariff storm, such as Brazil and Mexico.

Gareth Thomas

Head of Investment Management

*As a reminder all of these numbers are in GBP as that is the performance that matter to most of us based in the UK, and most of the underperformance of the US is attributable to significant weakness in the US Dollar, which has fallen by over 9% this year against a basket of global currencies.

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 9th January 2026 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20260109001